Navigating Business Challenges in Colombia: A Strategic Legal Perspective

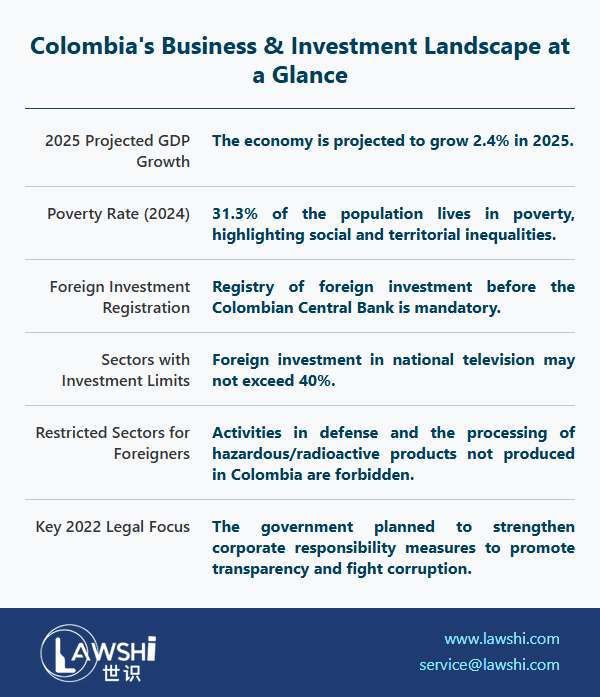

Colombia continues to stand as one of Latin America's most promising economies, attracting significant foreign investment across multiple sectors. However, establishing and maintaining successful business operations requires careful navigation of various regulatory, cultural, and operational challenges. Understanding these complexities from the outset enables investors to develop effective strategies for market entry and sustainable growth.

Establishing Your Business Presence

The initial step in launching business operations involves registration with the Chamber of Commerce in the relevant jurisdiction, followed by coordination with the National Tax Office (DIAN) and Municipal Tax Authorities. The specific requirements and processing timelines vary depending on the location of the corporate domicile, creating a landscape where local expertise becomes invaluable.

The Simplified Stock Corporation (Sociedad por Acciones Simplificada or SAS) has emerged as the predominant corporate vehicle for new ventures, largely displacing more traditional structures due to its administrative simplicity and flexibility. Unlike other entities, the SAS permits single ownership and does not require documentation to be formalized through public deeds, while its adaptable articles of association can be tailored to specific investor requirements. Capital contribution timelines extend to two years, providing additional operational flexibility during the establishment phase.

【Lawshi Professional Insight】

While the SAS structure offers significant advantages, the choice between different corporate vehicles should align with long-term strategic objectives. Companies anticipating future international expansion or substantial foreign investment often benefit from more traditional corporate structures that may provide better familiarity to international partners and investors.

Employment Framework and Labor Considerations

Colombia's labor environment operates under the comprehensive Labor Code, which governs all employment relationships regardless of nationality. The framework establishes clear parameters for contract formation, trial periods, compensation structures, working hours, leave entitlements, and termination procedures. The monthly minimum wage for 2024 stands at approximately COP$1,300,000 (roughly USD$325), with annual adjustments reflecting economic conditions.

【Lawshi Practical Tip】

Employers should pay particular attention to the gradual reduction of the standard work week from 48 to 42 hours by 2026, with corresponding adjustments to compensation structures and operational planning. Implementing compliant employment contracts from the outset prevents costly regularization processes and potential labor disputes.

Regulatory Compliance and Tax Environment

Colombia's regulatory landscape demonstrates ongoing evolution, with the country implementing its eighth tax reform in a decade. Recent changes have included increased corporate income tax rates, sector-specific surcharges for financial institutions, and modifications to local industry and commerce taxes (ICA). The digital transformation of tax administration continues advancing, with electronic invoicing now mandatory for all companies and electronic payroll reporting requirements fully implemented.

The construction permitting process involves multiple authorization layers addressing land use, building specifications, accessibility, and technical standards. While the theoretical timeline for license issuance approximates 45 days, practical experience suggests that preparation of comprehensive applications significantly influences actual processing durations.

Commercial Operations and Cross-Border Trade

Colombia's financial sector offers diverse credit access through more than 20 authorized institutions, providing generally competitive financing conditions. Investor protection mechanisms include commercial code provisions safeguarding minority shareholders through various instruments, including veto rights in specific circumstances.

International trade operations face certain administrative complexities, with border procedures typically requiring approximately two weeks for both import and export activities. The multilayer tariff system arising from Colombia's numerous economic integration agreements necessitates careful analysis to determine optimal customs strategies. While most products enter without import licensing requirements, value-added tax and applicable duties remain significant cost considerations.

【Lawshi Exclusive Service】

Our firm provides comprehensive trade compliance services, including tariff classification optimization, free trade agreement utilization, and customs valuation planning. We help clients navigate Colombia's complex web of international agreements to minimize duty liabilities and streamline cross-border operations.

Legal Enforcement and Business Culture

Contract enforcement through judicial channels remains a significant consideration, with proceedings potentially extending beyond three years and costs approaching half the claim value. Recent legislative developments, including Decree 560 of 2020, have introduced accelerated business recovery mechanisms, allowing debt restructuring and reorganization processes to conclude within three months under specific circumstances.

Colombia has substantially strengthened its anti-money laundering, counter-terrorism financing, and anti-bribery frameworks through comprehensive legislation and international cooperation. Both public and private entities have implemented robust compliance programs aligned with OECD standards and UN conventions.

Cultural considerations present additional dimensions for successful market integration. Despite strong American cultural influences, English proficiency remains limited in business contexts, requiring adapted communication strategies. Business protocols often feature indirect communication styles and flexible approaches to timing, while the business day frequently extends from early morning until evening, with Saturday considered a partial business day in many sectors.

Strategic Approach to Market Success

Successful market entry in Colombia requires balanced attention to legal compliance, operational practicality, and cultural adaptation. The evolving regulatory environment, particularly in taxation and digital reporting, demands ongoing vigilance and adaptive compliance strategies. Meanwhile, understanding the nuanced business culture and developing relationships with local experts significantly enhances operational effectiveness and risk management.

【Lawshi Professional Insight】

The convergence of Colombia's digital transformation with its frequent regulatory changes creates both challenges and opportunities. Companies implementing robust compliance technologies and processes from the outset gain significant competitive advantages through improved efficiency and reduced regulatory risk. Our integrated approach combines legal expertise with practical operational guidance to help clients build sustainable business models in the Colombian market.