Brazil's taxation system, established under the 1988 Constitution, creates a multi-layered framework that requires careful navigation by both domestic and international businesses. The distribution of taxing authority across federal, state, and municipal levels results in a comprehensive network of obligations that demand strategic planning and compliance expertise.

Corporate Income Tax Structure and Calculation Methods

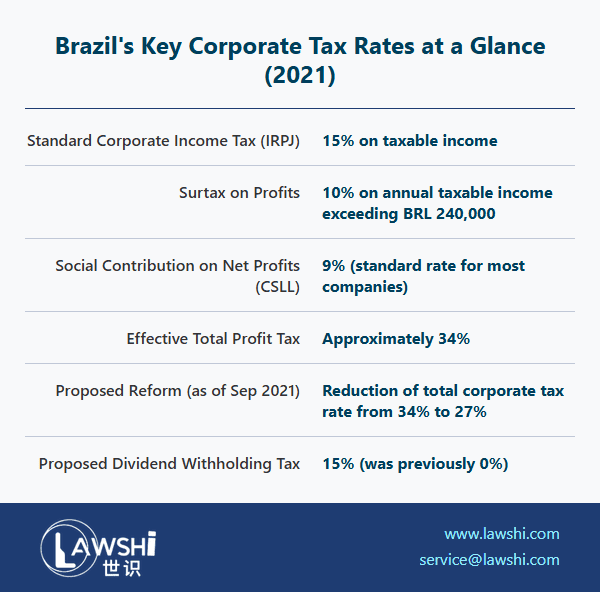

Brazilian corporate entities face multiple calculation methods for determining Corporate Income Tax (IRPJ) liability. The real profit method requires detailed accounting records and applies a 15% base rate plus a 10% surcharge on monthly profits exceeding R$20,000. Alternatively, the presumed profit method offers simplified calculation through predetermined profit margins, though its availability is restricted based on revenue thresholds and business activities.

【Lawshi Professional Insight】

The choice between real and presumed profit methods represents a strategic decision with implications beyond mere calculation simplicity. Companies approaching the R$48 million revenue threshold should conduct proactive modeling to understand the compliance implications of transitioning to mandatory real profit method reporting. The timing of this transition can significantly impact tax liability in the threshold year.

Tax loss utilization presents both opportunities and limitations within the Brazilian system. While losses can be carried forward to offset future taxable income, the 30% annual limitation on utilization means that profitable companies may require multiple years to fully absorb significant historical losses. This limitation necessitates careful tax planning around profitability projections and business expansion timelines.

Import Tax Considerations

Brazil's Import Tax applies to goods entering the national territory, with rates structured according to the Mercosur Common Nomenclature classification system. The non-recoverable nature of this tax distinguishes it from value-added systems common in other jurisdictions, making it a pure cost component for importing businesses.

【Lawshi Practical Tip】

Companies engaged in import activities should conduct thorough classification analysis to ensure proper tax rate application. We recommend obtaining advance rulings from Brazilian customs authorities for complex product classifications, as misclassification can lead to significant retroactive tax assessments and penalties.

Municipal Service Tax Framework

The Service Tax (ISS) operates at the municipal level, creating potential compliance complexities for businesses operating across multiple jurisdictions. The tax applies to services specifically enumerated in complementary legislation, with rates varying between 2% and 5% depending on both service type and municipal location.

The determination of taxing jurisdiction follows complex rules that consider both the service provider's location and where services are effectively rendered. This creates particular challenges for companies providing services across municipal boundaries, where conflicting municipal claims to taxing authority may arise.

Profit-Based Social Contributions

The Social Contribution on Net Profits (CSL) represents a significant additional levy on corporate earnings. The standard 9% rate for non-financial institutions applies to profits calculated under commercial law principles with specific statutory adjustments. The interaction between CSL and IRPJ creates a combined profit-based tax burden that requires integrated planning.

Gross Revenue Contributions: PIS and COFINS

The PIS and COFINS contributions apply to monthly gross revenue under either cumulative or non-cumulative regimes. The selection between these regimes is generally tied to the corporate income tax method, creating an interconnected system of tax compliance choices.

【Lawshi Exclusive Service】

Our firm provides comprehensive tax optimization analysis that considers the interplay between different tax calculation methods and regimes. We help clients structure operations to maximize PIS and COFINS credit utilization while ensuring full compliance with Brazil's detailed documentation requirements for credit claims.

The non-cumulative regime offers credit opportunities for various business inputs, though the technical requirements for credit qualification demand meticulous documentation and compliance procedures. The range of eligible credits extends beyond simple inventory acquisitions to include specific operational expenses and capital investments, creating opportunities for businesses that maintain robust tracking systems.

Payroll Taxation Complexities

Brazil's payroll tax burden represents one of the most significant components of labor costs, with combined rates typically ranging between 26.8% and 28.6%. The multiplicity of contributions directed to various social programs and entities requires careful accounting and remittance procedures.

The layered nature of Brazilian taxation demands coordinated compliance strategies that address federal, state, and municipal obligations simultaneously. Businesses operating in Brazil benefit from establishing comprehensive tax control frameworks that monitor legislative changes across all relevant jurisdictions while ensuring consistent application of tax accounting principles.

Strategic Tax Planning Considerations

Successful navigation of Brazil's tax environment requires understanding the interconnected nature of different tax regimes. Choices regarding corporate structure, operational locations, and accounting methods can have cascading effects across multiple tax types. Regular review of tax positions in light of evolving jurisprudence and administrative guidance remains essential for maintaining both compliance and optimization.

The complexity of Brazil's tax system, while challenging, also presents opportunities for businesses that invest in developing sophisticated tax expertise and compliance infrastructure. Properly managed, these obligations can be integrated into broader business strategies that support sustainable growth within Latin America's largest economy.