Lawshi has an office in Mexico City and has local practice experience since 2019. Our Mexican team consists of more than 20 lawyers who are fluent in Chinese and Spanish and are well versed in the Mexican legal system, providing all-round legal support for Chinese companies investing in Mexico.

Professional legal solutions tailored for Chinese companies to help you develop steadily in the Mexican market

Mexican company registration, foreign investment access, business license, RFC tax number application

Provide full legal support for cross-border M&A transactions, including due diligence, transaction structure design, negotiation and delivery services

Corporate income tax, VAT, tariff optimization, transfer pricing, tax compliance

Mexican fintech license application, compliance operations and payment solutions (in compliance with the Fintech Law and CNBV regulatory requirements)

Labor contracts, union negotiations, social security compliance, employee handbooks, labor disputes

Commercial arbitration, litigation agency, debt collection, intellectual property protection

As the second largest economy in Latin America and a member of the North American Free Trade Agreement (USMCA), Mexico is an ideal gateway for Chinese companies to enter the North American market. With its superior geographical location, huge consumer market and sound manufacturing base, Mexico has become an important part of the global supply chain.

Bordering the United States, it is a natural gateway to the North American market

USMCA member countries have signed free trade agreements with more than 50 countries, accounting for 60% of GDP and is an ideal gateway to the Latin American market.

130 million people, sufficient labor force with competitive cost

Improvement of industrial clusters such as automobiles, electronics, and aerospace

Benefiting from the restructuring of the global supply chain, a large number of manufacturing industries have been attracted to return to China

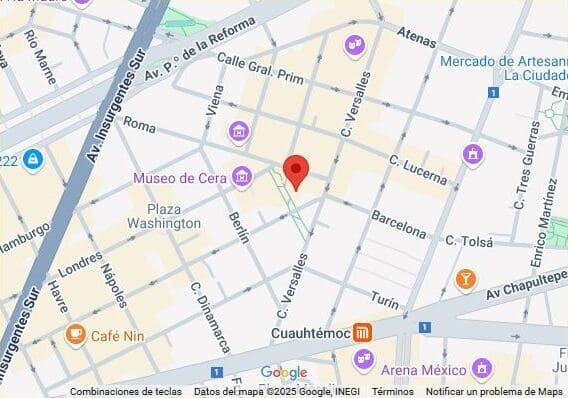

Our office in Mexico City is at your service.

Bruselas 6, Cuahtemoc,

CDMX, Mexico

Monday to Friday 9:00 - 18:00

Local time:

Clear your investment blind spots and avoid potential legal risks

Our Mexico team is here to provide you with professional legal support

Contact us