For foreign investors and entrepreneurs considering market entry into Chile, understanding the available business structures represents a critical first step in establishing a successful commercial presence. The Chilean legal system offers several distinct entity types, each with unique characteristics governing liability, management, and operational flexibility. This overview examines the four primary legal entities available to foreign companies and individuals seeking to conduct business in Chile.

Limited Liability Company (Sociedad de Responsabilidad Limitada - SRL)

The Limited Liability Company represents a popular choice for small to medium-sized enterprises, governed primarily by Law No. 3,918 while incorporating certain provisions from the Commerce and Civil Codes. This entity type provides members with liability protection limited to their capital contributions, unless the company's bylaws establish a higher amount. A distinctive feature of the SRL structure involves the requirement for unanimous partner approval for any transfer of equity rights, providing significant control over ownership changes but potentially limiting liquidity for members.

Management structure within an SRL offers considerable flexibility, with the bylaws determining administrative arrangements. In the absence of specific provisions, management authority defaults to all partners, either personally or through representatives. The bylaws may designate specific partners, third-party managers, or even establish a board of directors to oversee company operations, allowing customization based on the venture's specific needs and complexity.

【Lawshi Professional Insight】

The SRL's requirement for unanimous consent for ownership transfers creates both advantages and potential complications. While it protects against unwanted third-party involvement, it can lead to deadlock situations. We typically recommend including carefully drafted dispute resolution and exit mechanisms in the partnership agreement to address potential future conflicts among partners.

Corporation (Sociedad Anónima - S.A.)

The Corporation structure, regulated primarily by Law No. 18,046 (the Corporations Act) and supplementary Corporations Regulations, offers a more formalized framework suitable for larger business ventures. Chilean corporations fall into three categories: open (public) corporations that register shares with the Securities Registry under Financial Market Commission supervision; special corporations established for regulated activities like banking and insurance; and closed (private) corporations that represent the most common choice for foreign investors not seeking public financing.

A fundamental characteristic of the corporation involves the free transferability of shares, though shareholders' agreements may establish reasonable restrictions in private corporations. Shareholder liability remains limited to capital contributions, providing robust asset protection. Management follows a structured approach through a board of directors appointed by shareholders, which subsequently delegates operational authority to executives like the CEO while retaining overall governance responsibility.

【Lawshi Practical Tip】

When establishing a Chilean corporation, pay particular attention to the drafting of shareholders' agreements. These documents can effectively manage relationships between investors while establishing transfer restrictions that protect minority shareholders. Properly structured agreements can prevent future disputes and provide clear mechanisms for resolving deadlocks.

Simplified Corporation (Sociedades por Acciones - SpA)

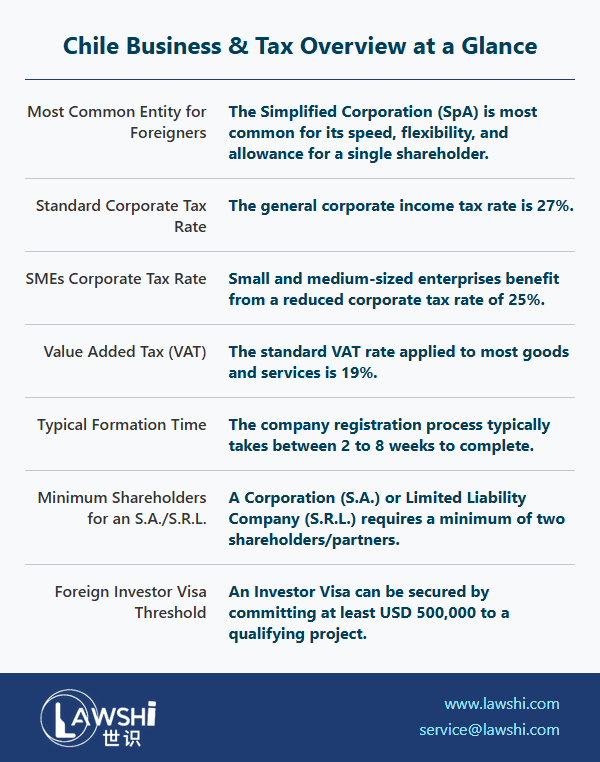

The Simplified Corporation has emerged as an increasingly popular vehicle for foreign investment due to its streamlined regulatory framework and operational flexibility. Established under special provisions within the Commerce Code, the SpA offers significant advantages for startups and smaller ventures, including the ability to operate with a single shareholder. Like traditional corporations, capital is divided into shares, providing familiar ownership structures while reducing administrative complexity.

The SpA's regulatory environment permits creative arrangements regarding management structures, profit distribution, voting rights, and share transfer restrictions that might not be permissible in other entity types. Management options are equally adaptable, allowing shareholders to designate specific individuals, employ third-party managers, or establish a board of directors according to the company's requirements and growth stage.

【Lawshi Exclusive Service】

Our firm provides comprehensive SpA formation services that leverage this entity's flexibility to create tailored governance structures. We specialize in drafting customized bylaws that establish specialized voting arrangements, profit distribution mechanisms, and dispute resolution procedures aligned with our clients' specific business objectives and relationship dynamics.

Branch of a Foreign Legal Entity (Agencia)

Establishing a branch office represents an alternative approach for foreign companies seeking Chilean market presence without creating a separate legal entity. Unlike incorporated entities, a branch does not constitute a distinct legal person, though it is treated as separate for certain tax purposes. The parent company remains governed by its home jurisdiction's laws while the branch must comply with specific Chilean requirements outlined in the Commerce Code and Corporations Act.

Management of a branch occurs through an agent appointed by the parent company, who receives extensive powers to represent the foreign entity in Chile. The power of attorney granted to this agent must explicitly state that they operate under the direct responsibility of the parent company, creating potential liability exposure for the foreign entity beyond the branch's local activities.

Strategic Considerations for Entity Selection

The choice between these entity types involves balancing multiple factors including liability protection, management flexibility, regulatory requirements, and tax implications. Foreign investors should consider not only their immediate operational needs but also long-term strategic objectives such as potential expansion, ownership changes, and exit strategies. Each structure offers distinct advantages that may align differently with various business models and investment horizons.

The Chilean business environment continues to evolve, with recent legal modifications generally trending toward increased flexibility and reduced administrative burdens for foreign investors. Nevertheless, proper entity selection remains crucial for establishing a solid foundation for commercial success while ensuring compliance with local regulatory requirements and optimizing tax efficiency.

【Lawshi Professional Insight】

Beyond the initial entity selection, foreign investors must consider how their chosen structure will interact with Chile's tax system, labor laws, and foreign investment regulations. The SpA's flexibility makes it particularly attractive for venture capital arrangements and joint ventures, while corporations better suit businesses contemplating future public offerings or significant external investment rounds.