The Chilean tax landscape presents significant considerations for investors contemplating corporate acquisitions. Understanding the nuanced treatment of different acquisition structures is crucial for optimizing tax outcomes and ensuring compliance with local regulations. This overview examines key tax aspects that influence acquisition strategy in the Chilean market.

Acquisition Structure: Asset versus Stock Transactions

The choice between acquiring a company's stock versus its business assets carries distinct tax implications under Chilean law. Stock acquisitions represent the most prevalent method for acquiring Chilean companies, offering several tax advantages. The transfer of company shares is not subject to value added tax (VAT), and the acquired company maintains its tax attributes, including the ability to utilize accumulated operational losses. These benefits make stock acquisitions particularly attractive from a tax perspective, though they require careful evaluation of potential historical liabilities.

Alternatively, acquiring specific business assets and liabilities may be preferable when the buyer seeks particular strategic assets rather than the entire corporate entity. This approach, however, generally triggers VAT at the standard rate of 19 percent. While Chilean-based acquirers may utilize this VAT as a tax credit, the transaction may also generate income tax obligations for the seller if the disposal results in capital gains. The selection between these approaches requires balancing tax efficiency with commercial objectives and risk management considerations.

【Lawshi Professional Insight】

The preservation of tax attributes in stock acquisitions extends beyond operational losses to include tax credits, depreciation schedules, and other tax positions. However, the tax authorities may challenge the use of losses if there's a substantial change in the company's business activities post-acquisition. Our experience shows that proactive engagement with tax authorities can provide certainty in these situations.

Tax Basis and Goodwill Treatment in Acquisition Structures

Chilean tax legislation does not permit a general step-up in the tax basis of business assets upon acquisition. The tax basis for acquired assets corresponds to the price effectively paid and allocated to each specific asset. This principle maintains consistency in asset valuation for tax purposes throughout the acquisition process.

Goodwill recognition becomes relevant when a buyer acquires 100 percent of a target company's stock and subsequently merges it with the acquiring entity. In such scenarios, any excess of the purchase price over the target's tax equity is treated as goodwill for Chilean tax purposes. This goodwill must then be allocated to non-monetary assets, with the allocated amount capped at each asset's fair market value. The portion of goodwill successfully allocated to specific assets becomes depreciable under standard tax depreciation rules. Any residual goodwill not covered by the fair market value of allocated assets is classified as a separate intangible asset, which may only be depreciated upon the company's dissolution.

【Lawshi Practical Tip】

The allocation of purchase price to specific assets requires careful documentation and valuation support. We recommend engaging independent valuation experts to establish fair market values that will withstand scrutiny from the Chilean Internal Revenue Service. Proper allocation not only optimizes depreciation benefits but also reduces future disputes with tax authorities.

Mergers and Share Exchanges as Acquisition Mechanisms

Both mergers and share exchanges represent valid acquisition methods under Chilean tax law, each with distinct tax characteristics. Mergers often provide tax efficiency advantages, as they can be structured as tax-neutral transactions in many circumstances. Additionally, mergers typically avoid income tax and VAT implications, making them an attractive consolidation mechanism. However, it is important to note that tax attributes and accumulated operational losses generally do not transfer to the surviving company in a merger scenario. These items remain with the original entity that generated them, requiring careful planning when considering merger transactions.

Share exchanges, in contrast, typically trigger income tax consequences as they constitute a sale transaction between parties. Any capital gains realized through share exchanges become subject to applicable taxation for both transacting parties. This fundamental difference in tax treatment significantly influences the selection of acquisition methodology.

Transaction Taxes and Liability Considerations

Chilean tax law does not impose documentary taxes, such as stamp duties, on the acquisition of stock or business assets. The Chilean Stamp Tax applies exclusively to loan transactions, with rates ranging between 0.066 percent and 0.8 percent of the principal amount. VAT at 19 percent may apply to business asset acquisitions, though Chilean-based acquirers who are VAT payers may generally utilize this as a recoverable tax credit.

A critical consideration in Chilean acquisitions involves successor liability, where the acquirer may inherit tax and other liabilities that accrued prior to the transaction. This exposure extends beyond tax matters to include labor, environmental, and other legal obligations. Consequently, comprehensive contractual protections, including detailed indemnity clauses and warranties, become essential components of acquisition agreements. These provisions should be carefully negotiated and documented within the acquisition contracts themselves.

【Lawshi Exclusive Service】

Our firm provides integrated due diligence and transaction structuring services to identify and mitigate potential successor liabilities. We develop tailored indemnification frameworks and implement escrow arrangements that protect our clients' interests while facilitating successful transaction completion. Our approach combines legal expertise with practical business acumen to create balanced solutions.

Payments made pursuant to indemnity or guarantee clauses carry their own tax implications. When such payments originate from a Chilean resident entity to a non-resident, they are subject to 35 percent withholding tax. Conversely, payments between two non-resident companies typically fall outside Chilean taxation. These nuances underscore the importance of strategic planning in acquisition agreements and dispute resolution mechanisms.

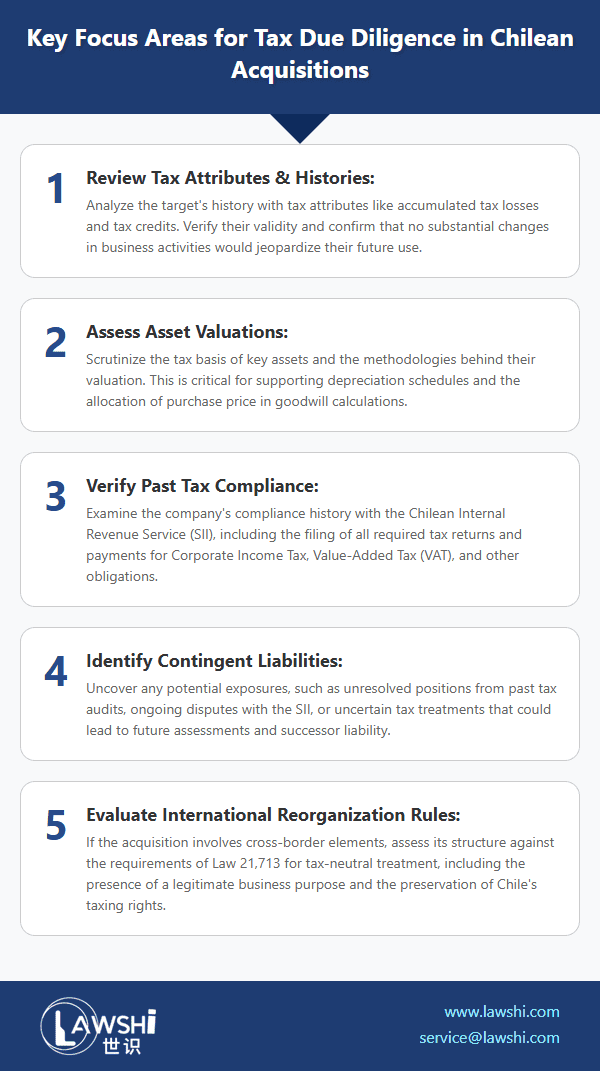

The complexity of Chile's tax environment for corporate acquisitions makes thorough tax due diligence an indispensable component of any transaction. Identifying potential exposures early in the process allows for appropriate risk allocation through purchase price adjustments, indemnification provisions, or other protective measures. With careful planning and expert guidance, investors can navigate these complexities to achieve their strategic objectives while maintaining tax compliance.