The rapid expansion of digital services across Latin America has prompted significant regulatory responses as governments seek to capture tax revenue from the growing digital economy. The region has witnessed a wave of legislative activity aimed at establishing clear tax obligations for digital service providers, creating both compliance challenges and strategic opportunities for international technology companies.

Regional Trends and OECD Influence

Latin American jurisdictions are demonstrating increasing alignment with global tax standards while adapting approaches to their specific economic contexts. The Organisation for Economic Co-operation and Development (OECD) has noted substantial progress in the region's efforts to address tax challenges arising from digitalization. This evolving framework aims to balance revenue generation with maintaining an attractive environment for digital investment.

【Lawshi Professional Insight】

The digital tax initiatives across Latin America predominantly target foreign-based digital service providers rather than domestic companies. This approach reflects both practical enforcement considerations and policy objectives to level the playing field between local and international competitors. Companies should monitor these developments closely as enforcement mechanisms become increasingly sophisticated.

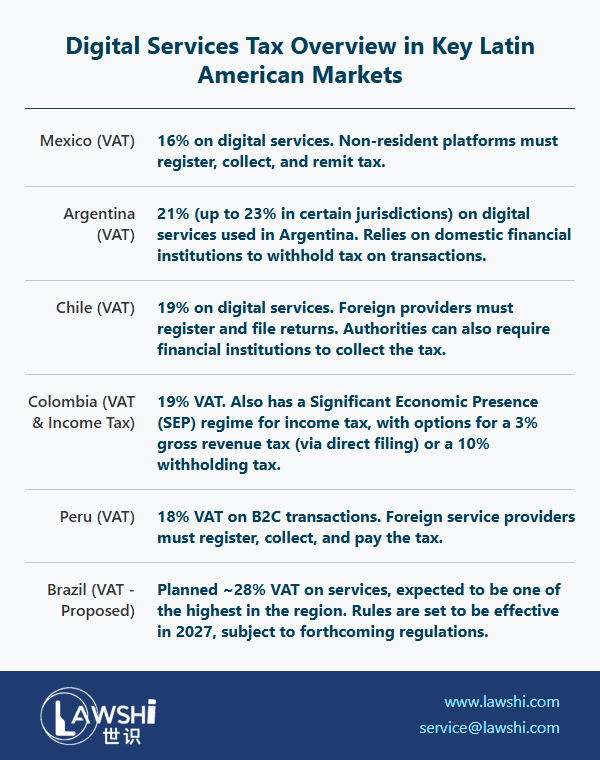

Country-Specific Digital Tax Frameworks

Argentina's Comprehensive Digital Services Tax

Argentina established its digital services taxation framework through Law 27,430, which took effect in June 2018. The legislation encompasses a broad range of services delivered through internet networks, applications, platforms, or equivalent technologies. The defining characteristic of covered services is their automated nature with minimal human intervention.

The Federal Administration of Public Revenues (AFIP) oversees compliance with these regulations, which apply regardless of the device used for service access or consumption. Tax rates vary depending on the specific digital service category, requiring careful classification by service providers.

【Lawshi Practical Tip】

Companies providing digital services in Argentina should conduct thorough service categorization analysis to ensure proper tax treatment. The automated nature test serves as the primary criterion for determining whether services fall within the digital tax regime. Maintaining detailed documentation of service delivery mechanisms can support appropriate tax classification.

Chile's VAT Implementation for Digital Services

Since June 2020, Chile has required foreign digital service providers to register, collect, and remit 19% Value Added Tax on sales to Chilean customers. The Chilean Internal Revenue Service (SII) has implemented a fully digital registration and compliance system, streamlining the process for international companies.

Colombia's Progressive Digital Tax Approach

Colombia has positioned itself as a regional leader in digital taxation, implementing its VAT regime for foreign digital service providers in January 2019. The DIAN (National Tax and Customs Directorate) enforces the 19% VAT obligation and possesses authority to mandate withholding by local payment processors if foreign providers fail to comply.

Ecuador's Emerging Digital Tax Framework

Ecuador's proposed digital tax framework, introduced in 2019, would impose a 12% VAT on digital services provided by non-resident businesses to Ecuadorian customers. The unique aspect of Ecuador's approach involves designating financial institutions as withholding agents responsible for tax collection.

Mexico's Tax Reform Impact

Mexico's 2020 tax reform extended VAT obligations to non-resident digital service providers, applying the standard 16% rate to services delivered to Mexican customers. The comprehensive nature of Mexico's digital service definition requires careful analysis by providers to determine applicability.

Brazil's Proposed CIDE-Digital Tax

Brazil's proposed digital tax legislation (PL 2358/2020) introduces a novel approach through the CIDE-digital contribution, which would function as a revenue-based tax rather than traditional income tax. The threshold requirements—global revenues exceeding R$3 billion and Brazilian revenues over R$100 million—target larger digital platforms specifically.

【Lawshi Exclusive Service】

Our firm provides comprehensive digital tax compliance services across Latin American jurisdictions, including registration support, tax calculation methodology development, and ongoing compliance monitoring. We help clients implement systems that accurately track digital service revenue by jurisdiction while maintaining compliance with evolving reporting requirements.

Strategic Considerations for Digital Service Providers

The digital tax landscape across Latin America demonstrates both convergence and divergence in approaches. While VAT-style taxes predominate, significant variations exist in registration thresholds, compliance mechanisms, and enforcement practices. Companies operating across multiple jurisdictions must develop nuanced strategies that address these differences while maintaining operational efficiency.

The trend toward digital service taxation shows no signs of abating, with several countries considering expanded definitions of taxable digital activities and enhanced enforcement mechanisms. Proactive compliance planning, including robust tracking systems for customer locations and service types, provides the foundation for sustainable operations in the region.

Compliance and Implementation Challenges

The practical implementation of digital tax obligations presents several challenges for international companies. These include accurately determining customer location, managing multiple registration requirements, navigating foreign language compliance systems, and adapting to frequent regulatory changes. Companies that invest in specialized compliance infrastructure and local expertise typically achieve more favorable outcomes than those attempting retroactive compliance.

Latin America's digital tax evolution reflects broader global trends while incorporating regional characteristics that demand specific attention. By understanding both the overarching patterns and country-specific requirements, digital service providers can develop compliant market strategies that support sustainable growth across this dynamic and increasingly important region.