The Latin American investment environment continues to evolve, presenting compelling opportunities for strategic acquirers seeking growth beyond traditional markets. The region's compelling demographic trends, combined with accelerating digital transformation and consumption patterns, have positioned it as a strategic destination rather than merely an alternative to saturated home markets. According to the MSCI Emerging Markets Index, Latin American investments have consistently delivered competitive returns, though realizing these opportunities requires nuanced understanding of regional dynamics.

Current Market Drivers and Economic Landscape

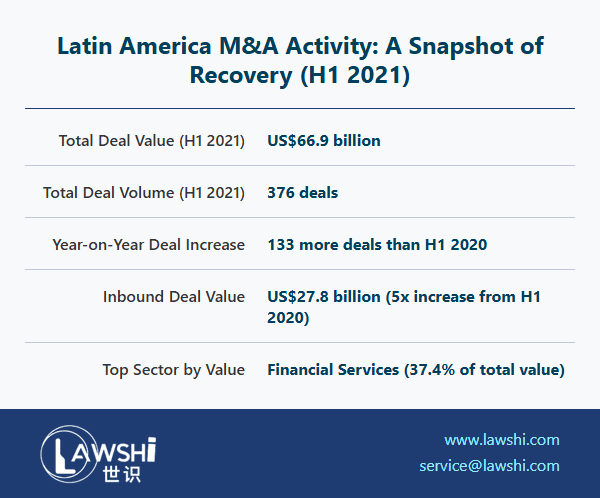

The Latin American M&A environment reflects a complex interplay of privatization initiatives, structural reforms, and monetary policy adjustments across key jurisdictions. Brazil's extensive privatization program has generated significant transaction volume, while parallel reforms in Peru and Colombia have enhanced investor confidence in these markets. The reduction of benchmark interest rates in several economies has additionally stimulated investment activity by improving capital accessibility.

【Lawshi Professional Insight】

The privatization trend across Latin America represents more than just asset sales—it signals fundamental shifts in economic policy and regulatory frameworks. Investors should approach these opportunities with comprehensive regulatory due diligence, as the transition from state to private ownership often involves complex legacy issues and ongoing governmental oversight requirements.

Sectoral analysis reveals concentrated investment patterns, with Energy, Resources, and Industrials capturing substantial capital allocation. The Financial Services Industry has similarly attracted significant investment, reflecting both consolidation trends and digital transformation initiatives. Regional variations in consumer market maturity have positioned Brazil and Chile as particularly active markets for consumer-focused acquisitions.

Geographic Investment Patterns and Regional Integration

Transaction data indicates strengthening intra-regional investment flows, with Brazilian, Chilean, and Mexican acquirers demonstrating particular activity across Latin American markets. This trend suggests growing sophistication among regional players and increasing market integration despite political and economic differences between countries.

【Lawshi Practical Tip】

When evaluating cross-border transactions within Latin America, investors should recognize that while regional integration is advancing, material differences in corporate governance standards, accounting practices, and regulatory enforcement persist. Implementing standardized due diligence protocols with country-specific adaptations helps ensure comprehensive risk assessment across multiple jurisdictions.

International investment patterns highlight sustained interest from North American, European, and Asian sources. The United States maintains its position as the most significant extra-regional investor, while European participation reflects particular strength in specific sectors including infrastructure and consumer goods. Asian investment, particularly from China and Japan, continues to expand beyond traditional resource extraction into technology and infrastructure development.

Sector-Specific Opportunities and Transformations

The Technology, Media, and Telecommunications sector demonstrates robust activity, with software and IT consulting representing the most active segment. This trend reflects the region's accelerating digital adoption and growing technology startup ecosystem. The Life Sciences and Healthcare sector similarly shows consolidation patterns, driven by both healthcare accessibility expansion and pharmaceutical innovation.

Consumer sector transactions reflect the region's evolving consumption patterns and growing middle class. Strategic acquirers are particularly focused on companies with strong brand positioning and distribution capabilities that can leverage demographic trends. The convergence of digital and traditional business models has created additional opportunities for transformational acquisitions.

Political and Regulatory Considerations

The Latin American political environment presents both challenges and opportunities for strategic acquirers. Leadership changes in Mexico, policy debates in Chile and Colombia, and electoral cycles in Argentina create periodic uncertainty that can affect transaction timing and valuation. However, these same conditions sometimes generate attractive entry points for investors with longer-term perspectives.

【Lawshi Exclusive Service】

Our firm provides integrated political risk assessment and regulatory monitoring services that help clients navigate Latin America's evolving policy environments. We combine legal expertise with local market intelligence to identify regulatory changes that may affect transaction structures, valuation assumptions, and post-acquisition integration plans.

Mining and extractive industries face particular scrutiny regarding environmental compliance and community relations. The growing emphasis on sustainable development and social license to operate has elevated the importance of comprehensive environmental, social, and governance (ESG) due diligence in these sectors.

Cultural and Operational Integration Considerations

Successful Latin American acquisitions require sensitivity to both linguistic differences and nuanced business cultures that vary significantly across the region. While surface-level Western business practices may appear familiar, underlying differences in negotiation styles, decision-making processes, and relationship-building expectations require thoughtful adaptation.

The due diligence process serves as the foundation for successful transactions in Latin America, with findings directly informing valuation adjustments and risk allocation mechanisms. Comprehensive due diligence should extend beyond financial and legal compliance to include operational, cultural, and market positioning factors that significantly influence post-acquisition performance.

Strategic Approach to Latin American M&A

The Latin American M&A landscape offers compelling opportunities for investors who approach the region with appropriate preparation and realistic expectations. Successful market entry strategies typically balance opportunistic positioning with disciplined risk management, recognizing both the region's growth potential and its unique challenges.

Investors should develop country-specific strategies that acknowledge material differences in regulatory environments, market structures, and competitive dynamics across Latin American jurisdictions. While regional trends provide helpful context, successful execution requires tailored approaches that reflect local market conditions and opportunity profiles.

The continuing evolution of Latin America's economic policies, combined with its favorable demographic trends and resource endowment, suggests sustained M&A activity across multiple sectors. Strategic acquirers who invest in understanding regional nuances and building local partnerships appear well-positioned to capitalize on these emerging opportunities while effectively managing associated risks.