Colombia's robust legal framework, anchored in constitutional protections for free enterprise and private initiative, has established the country as an increasingly attractive destination for international investment. The stability of corporate legislation, combined with progressive commercial codes, creates an environment conducive to business establishment and expansion. This comprehensive overview examines the essential elements of Colombian company law that foreign investors should understand when considering market entry.

Fundamental Principles for Foreign Investment

Colombia's corporate legal system demonstrates notable stability, with legislation that has evolved progressively to accommodate both domestic and international business needs. The framework provides foreign investors with considerable flexibility in structuring their Colombian operations, while maintaining clear guidelines for compliance and corporate governance.

A key advantage for international businesses is the absence of requirements for local partnership in most sectors. Foreign investors may maintain complete ownership of Colombian entities and face no restrictions on capital repatriation, providing significant operational autonomy. The incorporation process itself is generally streamlined, requiring no prior government authorization for most business activities.

【Lawshi Professional Insight】

While Colombia generally welcomes foreign investment, certain strategic sectors including defense, national security, and toxic waste handling may face ownership restrictions or require special approvals. We recommend conducting sector-specific analysis during the initial planning phase to identify any specialized regulatory requirements that may affect your investment structure.

Selection of Business Vehicles

Commercial Company Structures

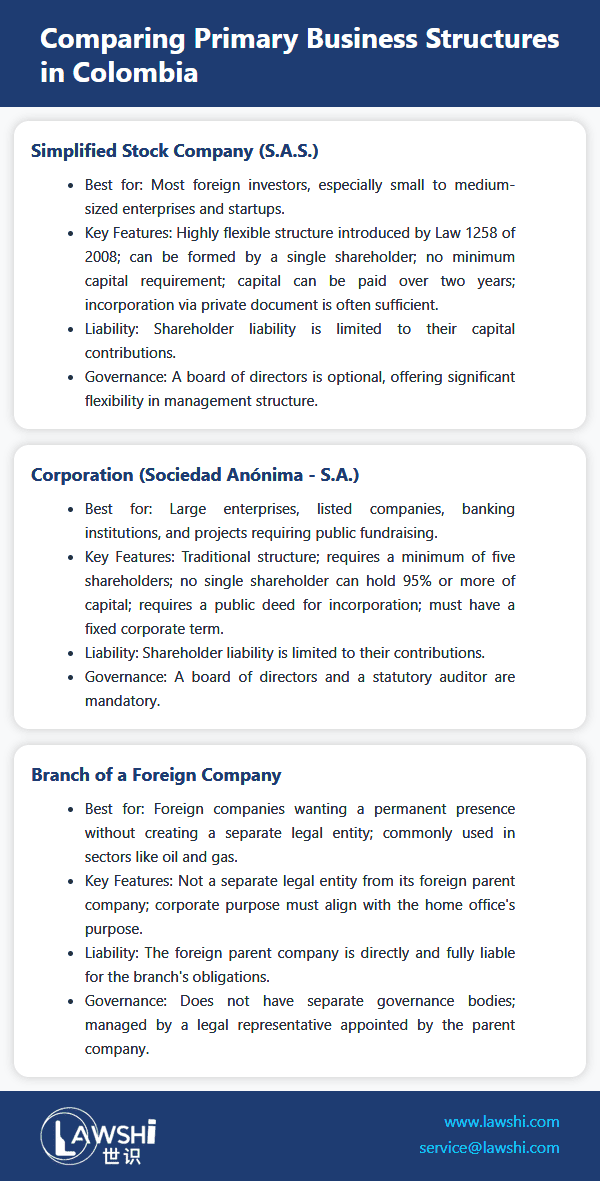

The Colombian commercial landscape offers several entity types, with three primary structures dominating the market for foreign investment. The Simplified Stock Company (Sociedad por Acciones Simplificada - S.A.S.) has emerged as the preferred vehicle due to its administrative flexibility and streamlined incorporation process. This structure permits significant customization of internal governance arrangements and operational terms through its bylaws.

Limited liability companies and traditional corporations (Sociedad Anónima - S.A.) remain available options, though the S.A.S. typically offers superior flexibility for small to medium-sized enterprises. The introduction of Benefit and Collective Interest Companies (BIC) under Law 1901/2018 provides a quality designation for companies integrating environmental, community, and worker considerations into their corporate purpose, though this represents a voluntary certification rather than a distinct legal structure.

Branch Operations

Foreign companies may establish branches as extensions of their parent entities, operating under the legal personality of the head office rather than as separate entities. The Commercial Code mandates branch establishment for foreign companies conducting permanent activities in Colombia, with the concept of permanence interpreted broadly to include various business operations.

【Lawshi Practical Tip】

The determination of "permanent activity" for branch registration purposes differs from the tax concept of permanent establishment. Businesses should carefully assess whether their planned activities trigger the branch registration requirement, as operating without proper registration can lead to significant penalties. Even advisory services or temporary project execution may qualify as permanent activities depending on their scope and duration.

Establishment and Registration Procedures

Commercial entities in Colombia are established through notarized documentation, with specific formalities varying by entity type. The registration process involves submission to the relevant Chamber of Commerce, which coordinates with the National Tax and Customs Office (DIAN) for tax registration. This integrated approach streamlines the initial compliance process, though careful attention to documentation requirements remains essential.

The appointment of legal representatives requires particular consideration, as Colombian law permits foreign nationals to serve in these roles regardless of residency status. However, statutory auditor positions must be filled by Colombian public accountants, creating specific localization requirements for corporate governance structures.

Tax Registration and Compliance

The National Tax Registry (Registro Único Tributario - RUT) serves as the foundational tax identification for Colombian entities, obtained during the incorporation process or directly through DIAN following commercial registration. Legal representatives must obtain their own Tax Identification Numbers (NIT) and electronic signatures, regardless of residency status, to fulfill compliance obligations on behalf of their entities.

【Lawshi Exclusive Service】

Our firm provides comprehensive entity establishment services that coordinate commercial registration, tax compliance, and foreign investment reporting. We assist clients in selecting optimal corporate structures, preparing required documentation, and navigating the multi-stage registration process to ensure efficient market entry while maintaining full regulatory compliance.

Documentation Requirements for International Investors

Foreign investors unable to attend incorporation procedures personally must provide properly legalized powers of attorney, with authentication requirements varying based on the investor's country of origin. Documents originating outside Colombia require apostille certification or consular legalization, accompanied by official Spanish translations for non-Spanish documents.

The specific documentation requirements differ between subsidiary formations and branch establishments, with branches necessitating more extensive information about the parent entity's governance and operational status. Careful preparation of these materials ensures smooth progression through the registration process.

Capitalization and Foreign Investment Reporting

Colombian legislation generally imposes no minimum capital requirements for commercial entities, allowing shareholders to determine appropriate capitalization levels based on planned business activities. The contribution regime accommodates various asset types, provided they are convertible to monetary value, offering flexibility in initial funding arrangements.

Payment timelines vary by entity structure, with S.A.S. entities benefiting from the most extended payment periods of up to two years. Foreign capital inflows require registration with the Colombian Central Bank through authorized foreign exchange market intermediaries, with the "Declaración de Cambio" serving as the primary mechanism for foreign investment recording.

Strategic Considerations for Market Entry

The Colombian corporate framework provides international investors with multiple pathways for market entry, each with distinct advantages depending on investment objectives and operational models. The flexibility in corporate structures, combined with straightforward establishment procedures, supports efficient market entry while providing foundations for sustainable operations.

Ongoing compliance requirements necessitate systematic approaches to corporate governance, particularly regarding documentation of corporate decisions and maintenance of statutory records. Implementing robust internal processes from inception helps prevent compliance gaps as operations expand and evolve.

Colombia's progressive approach to corporate regulation, characterized by constitutional protections for private enterprise and increasingly streamlined administrative processes, creates a favorable environment for international investment. With proper guidance and strategic planning, foreign investors can effectively leverage these advantages to establish successful and compliant operations within the Colombian market.