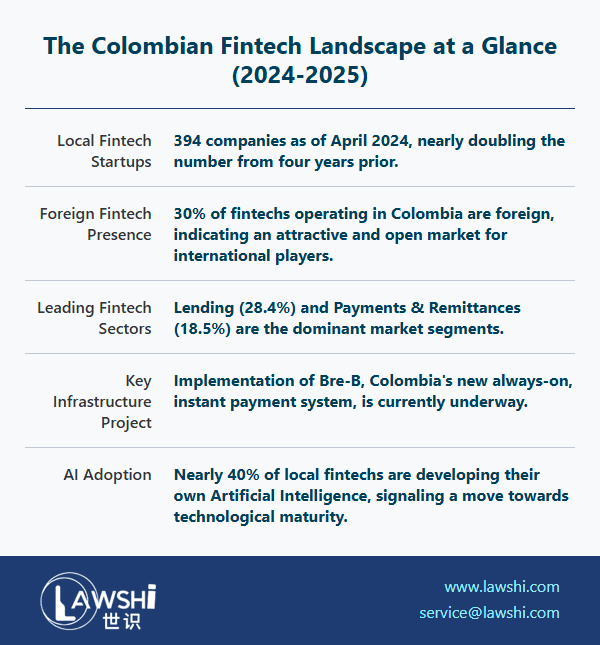

The Colombian Fintech sector represents a dynamic and rapidly evolving component of the nation's financial landscape. While Colombian regulations do not explicitly define "Fintech companies," the term generally encompasses businesses that develop or apply technological innovations to provide financial, securities, or insurance services, resulting in new business models, applications, processes, or products. The regulatory approach has evolved significantly in recent years to accommodate technological innovation while maintaining financial system stability and consumer protection.

Establishing a Fintech Company in Colombia: Corporate and Regulatory Requirements

The legal framework governing Fintech establishment depends primarily on whether the company intends to conduct activities involving public fund management. For entities planning to engage in financial, securities, or insurance activities—particularly those involving the management, use, or investment of resources collected from the public—prior authorization from the Financial Superintendence of Colombia (Superintendencia Financiera de Colombia or SFC) is mandatory. This entity serves as the technical body responsible for inspecting, monitoring, and controlling entities engaged in such activities.

Regarding corporate structure, financial institutions supervised by the SFC must be established as joint-stock companies (sociedades anónimas) or cooperative associations. Additionally, entities falling under SFC supervision must demonstrate adequate minimum capital requirements, which vary depending on the specific financial activities contemplated.

For Fintech companies whose activities fall outside traditional financial services regulated by the SFC, incorporation follows general corporate rules applicable to their specific business activities. These entities typically register as standard commercial companies under Colombian law, though they must still comply with relevant sector-specific regulations that may apply to their operations.

【Lawshi Professional Insight】

The distinction between regulated and unregulated Fintech activities represents a critical threshold determination for entrepreneurs. Many Fintech business models operate in regulatory gray areas where seemingly technological services may inadvertently trigger financial regulation. We recommend conducting a comprehensive regulatory analysis before incorporation to properly classify your activities and avoid future compliance issues.

Colombia's Evolving Fintech Regulatory Framework

Colombia has progressively developed specialized regulations to address various Fintech segments while encouraging financial innovation. The regulatory approach has evolved from addressing specific sectors like crowdfunding to creating broader innovation frameworks such as regulatory sandboxes.

Crowdfunding Regulation

In 2018, Colombia established a formal regulatory framework for crowdfunding through Decree 1357, recognizing its potential to expand financing sources for small and medium enterprises. The regulations distinguish between different crowdfunding models and establish specific operational limits. Productive projects may be financed for amounts up to approximately 58,000 minimum monthly legal wages, while non-qualified investors may allocate up to 20% of their annual income or equity to such financing mechanisms. The regulations also establish platform operator requirements, investor protection measures, and transparency obligations.

Strategic Investments in Fintech Innovation

Recognizing the synergy potential between traditional financial institutions and Fintech innovators, Colombian regulations now authorize credit establishments, financial services companies, and capitalization companies to invest in innovation and financial technology companies. This regulatory development, formalized through Decree 2443 of 2018, has facilitated strategic partnerships and acquisitions that benefit both established financial institutions seeking digital transformation and Fintech companies requiring scaling capital and market access.

【Lawshi Practical Tip】

When structuring investments between traditional financial institutions and Fintech startups, particular attention must be paid to corporate governance arrangements, intellectual property protection, and regulatory compliance responsibilities. Clear agreements regarding data sharing, customer ownership, and liability allocation are essential for successful partnerships.

The Regulatory Sandbox for Financial Innovation

Colombia has implemented a regulatory sandbox framework that allows entities to test innovative financial products, services, or business models under relaxed regulatory requirements for a limited period. This controlled environment enables innovators to validate their solutions while maintaining appropriate consumer protections.

Entities seeking to participate in the sandbox must submit a comprehensive application to the SFC that demonstrates several key elements. The application must clearly articulate the innovative nature of the technological development and how it aligns with regulatory objectives. A detailed business model must be presented, including the proposed financial product or service, business feasibility analysis, and specific goals. The application should identify which prudential requirements need flexibility and justify this need proportionally in accordance with the business model.

Additionally, applicants must present robust risk management policies specifically tailored to the innovative technological developments being tested. This includes policies for managing conflicts of interest and specific risk analysis frameworks for the new products or services. The application must clearly define the test's scope, including target market specifications, geographic limitations, maximum resource caps per consumer, and total operational limits during the testing period.

【Lawshi Exclusive Service】

Our firm provides end-to-end support for regulatory sandbox applications, including document preparation, regulatory strategy development, and liaison with authorities. We help clients structure their applications to maximize approval chances while maintaining appropriate risk management frameworks that satisfy regulatory concerns.

Conclusion

Colombia's Fintech regulatory landscape continues to mature, offering increasingly structured pathways for innovation while maintaining financial system integrity. Success in this environment requires careful navigation of both general corporate requirements and specialized financial regulations. As the ecosystem evolves, we anticipate further regulatory refinements that will continue to shape opportunities and requirements for Fintech entrepreneurs.

Foreign investors and local entrepreneurs alike should approach the Colombian Fintech market with both optimism and appropriate professional guidance to ensure compliance while maximizing innovation potential. The country's balanced approach to regulation—encouraging innovation while protecting consumers—creates a promising environment for responsible Fintech development.