Chile has consistently distinguished itself as Latin America's most competitive economy, characterized by sustained economic growth, political stability, and transparent regulatory frameworks. The country's pioneering approach to foreign investment attraction has positioned it as a premier destination for international business expansion within South America. Understanding Chile's streamlined yet specific registration requirements enables investors to efficiently establish their corporate presence in this dynamic market.

Strategic Advantages of Chilean Investment

Chile's economic landscape offers compelling advantages for international investors, including equal treatment of domestic and foreign entities, transparent regulatory policies, and largely unrestricted access across economic sectors. The country's high GDP per capita and stable institutional framework create an environment conducive to sustainable business development and long-term investment protection.

【Lawshi Professional Insight】

Chile's commitment to foreign investment extends beyond regulatory frameworks to include comprehensive international trade agreements and investment protection treaties. The country has established itself as a gateway to Latin American markets while maintaining robust bilateral agreements with economies worldwide. This network provides exceptional market access opportunities for companies establishing their regional headquarters in Chile.

Comprehensive Registration Framework

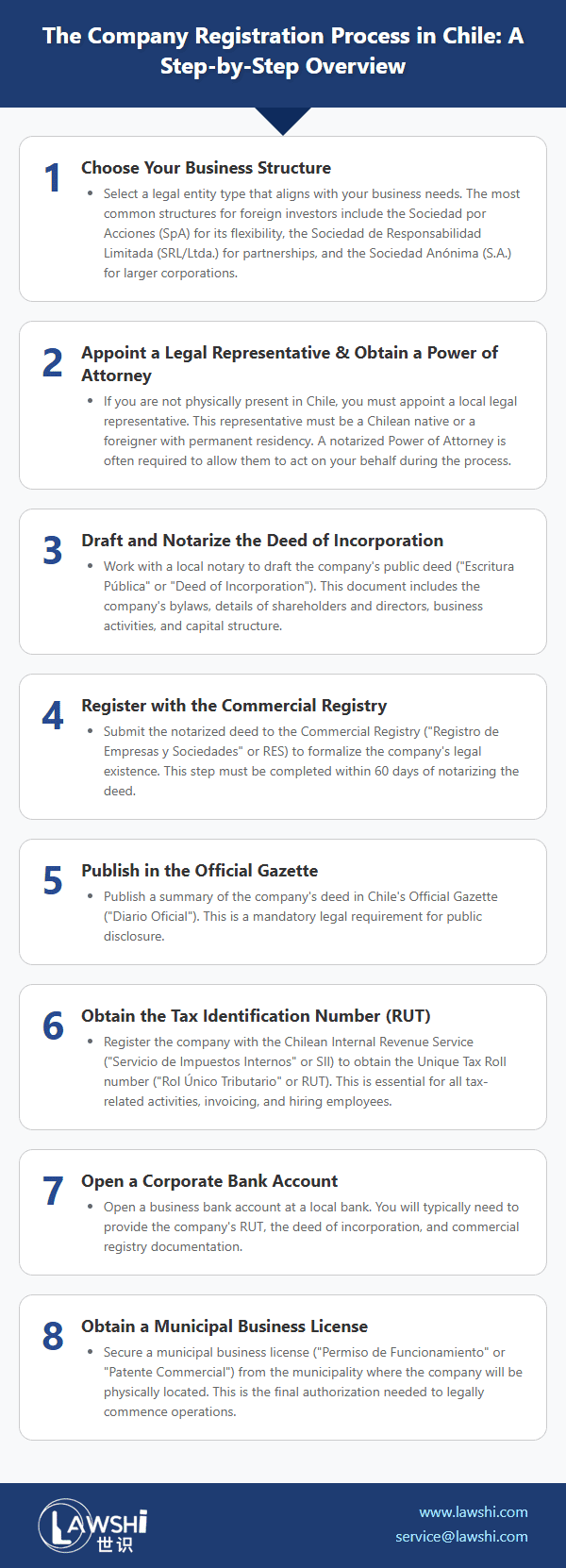

The company establishment process in Chile follows a structured pathway that balances regulatory compliance with operational efficiency. Foreign investors typically initiate the process while present in Chile, often utilizing tourist visa status for initial procedures before transitioning to appropriate investment visas for long-term management.

The foundational step involves obtaining the RUT (Rol Único Tributario) tax identification number, which serves as the essential credential for all commercial and corporate operations. This unique identifier facilitates interactions across Chilean governmental and financial systems, creating the administrative foundation for business activities.

【Lawshi Practical Tip】

While investors can initiate registration processes with a tourist visa, we strongly recommend advancing to appropriate investment visas before conducting significant financial operations. Banking institutions increasingly scrutinize visa status for corporate account holders, and proper immigration status streamlines financial management and compliance reporting.

The formal company registration requires notarized bylaws execution, followed by the critical Business Start-up Declaration ("Iniciación de Actividades") with the Internal Revenue Service (SII). This declaration activates the company's tax obligations and enables subsequent operational authorizations, including the essential certification of legal domicile.

Capitalization Requirements and Visa Considerations

Chile's flexible approach to corporate capitalization imposes no minimum capital requirements, allowing shareholders to determine appropriate funding levels based on business objectives and operational needs. The acceptance of diverse contribution types—including cash, property, technology, and service commitments—provides significant structuring flexibility for international investors.

【Lawshi Exclusive Service】

Our firm provides integrated company registration and visa processing services that coordinate corporate establishment with immigration requirements. We assist clients in preparing compelling investment visa applications, structuring appropriate capitalization plans, and navigating the sequential requirements to optimize both corporate and personal immigration status in Chile.

The investor visa process represents a parallel pathway to corporate registration, requiring demonstration of approximately US$10,000 in investment capacity. This temporary residency status facilitates proper corporate governance and financial management, with a pathway to permanent residency available after nine months of continuous temporary status.

Post-Registration Compliance and Operational Readiness

Successful company registration initiates ongoing compliance obligations, including proper documentation stamping authorizing VAT credit mechanisms and invoice issuance capabilities. The implementation of robust accounting systems aligned with SII electronic reporting requirements proves essential from operational inception.

The Chilean tax environment combines national-level administration with specific municipal obligations, creating a streamlined yet comprehensive compliance framework. The country's advanced digital infrastructure facilitates efficient tax reporting and payment processes, though proper system configuration requires specialized local expertise.

Chile's combination of market accessibility, institutional stability, and progressive business regulations creates optimal conditions for international expansion. By understanding the specific registration pathways and implementing strategic approaches to corporate structuring, investors can effectively establish their presence while positioning operations for sustainable growth within Chile's dynamic economy. The country's proven track record of economic resilience and commitment to foreign investment protection reinforces its position as Latin America's most reliable business destination.