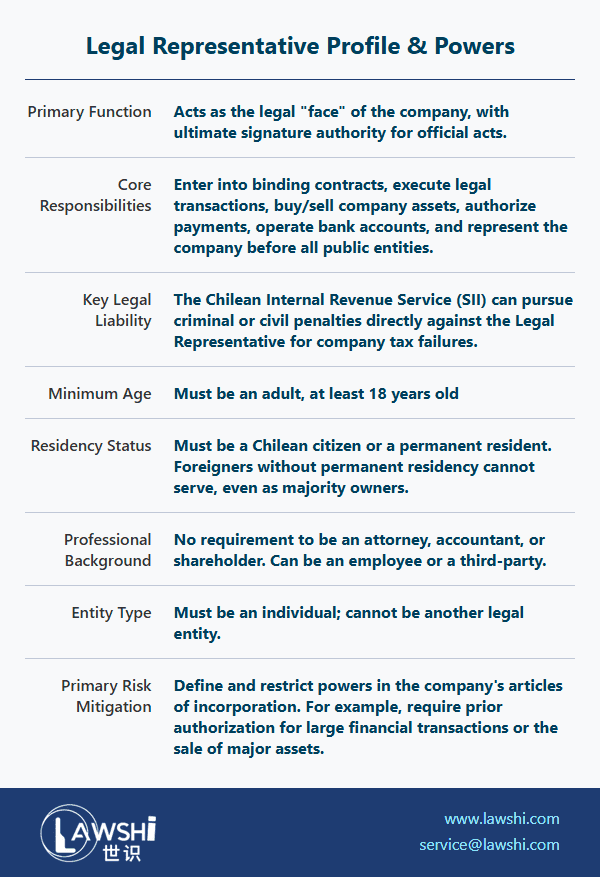

In Chile, the appointment of a legal representative is a foundational step for any company, yet it is often misunderstood, especially by foreign investors. Under Chilean law, a legal representative must be an adult over the age of 18 and either a permanent resident or citizen of Chile. There is no requirement for the individual to be an attorney, accountant, or even a shareholder in the company. They can be an employee or a third-party volunteer. However, foreigners who own a majority stake in a company are barred from serving as legal representatives until they obtain full permanent residency status. This role designates the individual as the legal “face” of the company, granting them ultimate signature authority over all official acts. While this centralization of power is designed to streamline decision-making, it also introduces significant risks if not properly managed.

The Challenge of Concentrated Authority in Chilean Companies

The role of a legal representative in Chile concentrates considerable power in the hands of one or a few individuals. This can lead to serious issues, particularly when foreign partners or owners, who may have limited Spanish proficiency or understanding of local laws, fail to grasp the full extent of the authority they have delegated. The appointment of a legal representative is typically formalized through a notarized document, which is binding on all parties and provides legal protection to third parties acting in reliance on it. The intent of the signers is considered settled at the moment of notarization, leaving little room for later disputes.

We have observed numerous cases where legal representatives have abused their positions, such as by selling company assets or seizing control of the organization. In extreme situations, owners found themselves with limited legal recourse because they had previously granted unrestricted powers to the representative. This underscores the importance for foreigners to exercise extreme caution when selecting a legal representative, defining the scope of their powers, and establishing clear conditions for their actions.

【Lawshi Professional Insight】

The notarized document appointing a legal representative is a powerful instrument under Chilean law. Once executed, it is difficult to revoke or amend without following strict legal procedures. Foreign investors should seek expert legal advice before signing such documents to ensure that the powers granted are aligned with their business objectives and risk tolerance.

Legal Liability Assumed by Legal Representatives

The responsibilities of a legal representative also carry personal legal consequences. For instance, if a company fails to meet its tax obligations, the Chilean Internal Revenue Service (Servicio de Impuestos Internos) may pursue criminal or civil penalties directly against the legal representative. In civil litigation, it is the legal representative who is served with court documents and required to appear on behalf of the company. This personal exposure means that the role should not be taken lightly, both by the company and the individual assuming the position.

【Lawshi Practical Tip】

To mitigate personal liability, legal representatives should ensure that the company maintains strict compliance with all local regulations, particularly in tax and corporate governance matters. Regular audits and professional advisory services can help prevent unforeseen legal issues.

Strategies to Mitigate Risks When Appointing a Legal Representative

The most effective way to reduce risks associated with legal representatives is through careful drafting of the company’s articles of incorporation and any related contracts. Specifically, the powers granted to the legal representative should be clearly defined and appropriately restricted. For example, the articles might require the legal representative to obtain prior authorization from partners or shareholders for significant actions, such as the sale of real estate assets. Similarly, financial limits can be imposed—such as requiring approval for transfers exceeding $10,000 USD—to prevent unauthorized use of company funds.

At the same time, it is essential that these restrictions do not hinder the legal representative’s ability to perform day-to-day operations. The representative must retain sufficient authority to act promptly in routine matters. Therefore, a balanced approach is necessary, one that safeguards the interests of the owners without compromising operational efficiency.

【Lawshi Exclusive Service】

At Lawshi, we assist clients in structuring the role of the legal representative to align with both Chilean legal requirements and the company’s operational needs. Our services include drafting tailored articles of incorporation, establishing internal control mechanisms, and providing ongoing legal support to ensure compliance and mitigate risks.

Conclusion

The role of a legal representative in a Chilean company is both powerful and fraught with potential pitfalls. For foreign investors, understanding the legal framework and implementing prudent safeguards is critical to protecting their investments. By defining the scope of authority, incorporating checks and balances, and seeking professional guidance, companies can leverage the benefits of this role while minimizing associated risks. As always, proactive legal planning is the key to successful and secure business operations in Chile.