The Peruvian tax system presents both opportunities and complexities for foreign investors, with distinct treatment for domestic and foreign entities, specific deduction limitations, and evolving compliance requirements. Understanding these elements is crucial for structuring investments efficiently and maintaining regulatory compliance.

Corporate Taxation Framework in Peru

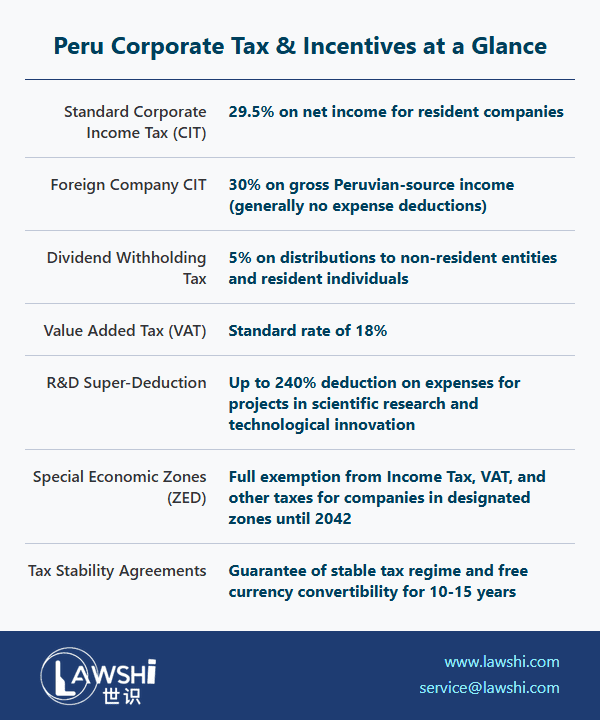

Peruvian-incorporated companies are subject to income tax on their worldwide income at a corporate tax rate of 29.5%, applied to net income. In contrast, non-domiciled corporations—including branches, agencies, and permanent establishments of foreign entities—are generally taxed solely on Peruvian-source income. This fundamental distinction significantly impacts how multinational corporations structure their Peruvian operations and plan their global tax positioning.

Dividend treatment varies depending on the source. Dividends received from Peruvian-domiciled entities are exempt from taxation, while those from non-domiciled entities are taxed at the standard corporate rate of 29.5%. This creates a clear incentive for establishing Peruvian corporate entities when distributing local earnings.

【Lawshi Professional Insight】

The distinction between domiciled and non-domiciled entities is particularly important for multinational corporations considering regional headquarters structures. Companies with significant operations in multiple Andean countries often benefit from establishing a Peruvian domiciled entity rather than operating through branches, which face limitations on expense deductions and higher effective tax rates on gross income.

Deduction Limitations and Tax Credit Mechanisms

The Peruvian tax system permits deductions for expenses deemed necessary to generate or maintain taxable income sources. However, investors should be aware that specific limitations apply to certain expense categories, including thin capitalization rules governing interest deductions, bad debt provisions, compensation arrangements, travel expenses, gifts, donations, and penalties. These restrictions require careful advance planning to optimize the tax efficiency of operational structures.

Peruvian tax law provides mechanisms to credit various payments against income tax liabilities. These include advance income tax payments, specific other tax payments, and foreign income taxes paid—subject to the condition that the foreign jurisdiction's tax rate does not exceed Peru's corporate income tax rate and the income qualifies as foreign-source under Peruvian tax principles. This foreign tax credit mechanism helps mitigate double taxation for Peruvian companies with international operations.

Dividend Distribution Taxation and Anti-Avoidance Measures

Dividends and profit distributions are subject to a 5% withholding tax when distributed to non-resident entities or resident individuals. Resident legal entities are exempt from withholding tax on dividends received from other Peruvian corporations. The distributing entity bears responsibility for withholding the applicable taxes at the prescribed rates.

Peru has implemented significant anti-avoidance measures, including an additional 5% tax on amounts recharacterized as taxable income following tax audits. This applies particularly to indirect distributions that escape normal tax administration controls, including undeclared income. This provision empowers tax authorities to challenge transactions they deem to constitute disguised profit distributions.

【Lawshi Practical Tip】

Maintaining comprehensive documentation supporting the business purpose of transactions is essential to defending against potential recharacterization by Peruvian tax authorities. We recommend implementing robust transfer pricing documentation and ensuring all intercompany transactions reflect arm's length principles to mitigate audit risks.

Special Regime for Foreign Corporations and Beneficial Ownership Disclosure

Foreign corporations not domiciled in Peru face a notably different tax treatment. They are generally subject to a 30% income tax rate on gross Peruvian-source income, with limited opportunities for expense deduction. This gross-based taxation can result in significantly higher effective tax rates compared to net-based taxation applied to domiciled entities, particularly for businesses with substantial operational costs.

Since 2019, Peruvian legal entities have been required to identify, maintain, and disclose information regarding their ultimate beneficial owners. The reporting criteria encompass individuals who directly or indirectly own at least 10% of the entity's shares, those with significant control over management decisions, or—when no such individuals can be identified—the person holding the highest administrative position within the organization.

【Lawshi Exclusive Service】

Our firm provides comprehensive compliance support for beneficial ownership reporting requirements, including initial identification processes, ongoing monitoring, and submission of required declarations. We help clients implement internal systems to track ownership changes and ensure continuous compliance with evolving regulatory expectations.

Strategic Planning Considerations

The Peruvian tax landscape requires careful navigation to optimize investment structures. The choice between establishing a domiciled entity versus operating as a non-domiciled branch involves weighing multiple factors, including the ability to deduct expenses, utilization of tax credits, dividend distribution policies, and compliance obligations. Recent emphasis on transparency and beneficial ownership reporting adds another layer of complexity that demands systematic attention.

Investors should consider these elements holistically when planning market entry or restructuring existing Peruvian operations. Proactive tax planning that addresses both current operations and anticipated expansion plans can yield significant benefits while ensuring full compliance with Peruvian tax obligations.