Peru has established itself as a prominent investment destination within Latin America, bolstered by a robust legal framework rooted in its 1993 Constitution and mechanisms designed to ensure legal stability for investors. The nation's tax system, once celebrated for its simplicity with just four primary national taxes, has undergone significant transformations over the past decade. While implemented with social equality objectives, these changes have introduced complexity and reduced predictability for foreign investors considering acquisitions or dispositions of Peruvian companies.

Critical Considerations When Investing in Peruvian Companies

A fundamental requirement under Peruvian law mandates that all payments for assets—where future transfer may generate taxable capital gains—must be channeled through the Peruvian financial system. This requirement applies equally to capital contributions and share acquisitions, presenting particular challenges when neither buyer nor seller maintains Peruvian bank accounts.

【Lawshi Professional Insight】

The financial channeling requirement serves dual purposes for tax authorities: it creates an audit trail for transactions and helps prevent money laundering. However, this presents practical difficulties for foreign investors without existing Peruvian banking relationships. The requirement applies regardless of whether the transaction occurs between related or unrelated parties.

To navigate this regulatory requirement, legal advisors typically recommend one of two approaches: utilizing a existing Peruvian entity's bank account with specially drafted instructions or establishing an escrow arrangement with a local financial institution. Failure to comply with this requirement carries significant consequences—the investor will be denied tax basis recognition for future dispositions of their Peruvian investment.

【Lawshi Practical Tip】

We strongly recommend establishing the banking infrastructure before finalizing any investment agreements. For time-sensitive transactions, using an escrow agent provides a reliable solution. Document the entire payment trail meticulously, as you'll need to demonstrate compliance during the "capital recovery" process for future disposals.

Tax Implications When Disposing of Peruvian Investments

Direct Share Transfers

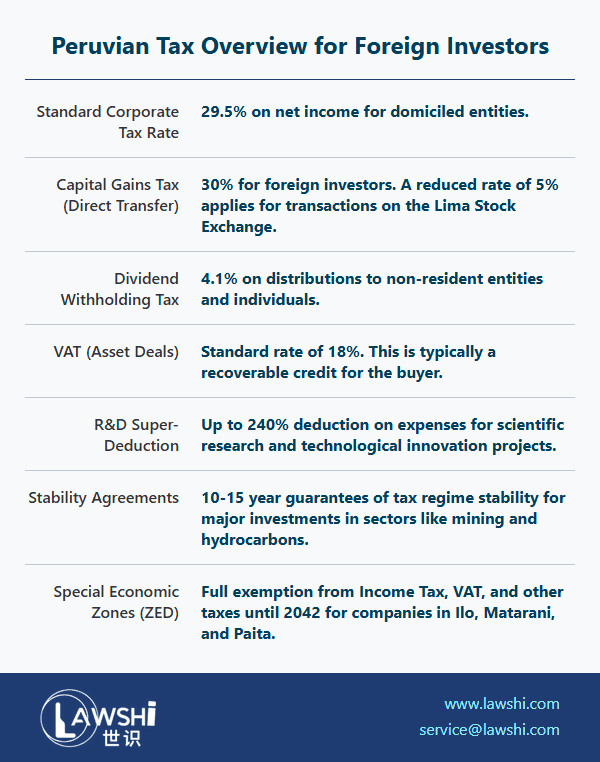

Capital gains derived from direct transfers of shares in Peruvian entities are considered Peruvian-source income and subject to income tax. Foreign investors generally face a 30% tax rate, though this drops to 5% (or potentially 0% in specific cases) for transactions executed through the Lima Stock Exchange.

The taxable gain calculation compares the higher of the agreed price or fair market value against the tax basis recognized by the Peruvian Tax Administration (SUNAT). Determining fair market value follows different methodologies depending on the relationship between parties. For unrelated parties, it's based on equity value from the latest financial statements. For related-party transactions or those involving jurisdictions considered non-cooperative or low-tax, transfer pricing rules apply, typically requiring valuation based on future cash flow methodologies.

The process of establishing tax basis, known as "recuperación de capital invertido," involves a formal procedure where investors must submit evidence of their investment to SUNAT. This process can take up to 30 business days and results in a certification stating the basis in Peruvian currency.

Indirect Transfer Provisions

Since 2012, Peru has extended its tax reach to include gains from certain transfers of foreign entity shares that qualify as "indirect transfers of Peruvian companies." The rules encompass two primary scenarios:

Transfers of 10% or more of a foreign entity's shares by a person or its affiliates within a 12-month period, where over 50% of the share value derives from underlying Peruvian entities.

Transfers of foreign entity shares where the underlying Peruvian entities have a fair market value exceeding 40,000 tax units (approximately USD 1,240,000 based on current values).

【Lawshi Exclusive Service】

Our firm provides comprehensive indirect transfer analysis, including valuation assessments to determine whether transactions trigger Peruvian tax obligations. We assist clients in structuring international transactions to minimize unintended tax consequences while maintaining full compliance with Peru's evolving regulations.

The calculation methodology for determining the Peruvian-taxable portion of foreign share sales involves complex allocation rules addressing the fair market value of both foreign and Peruvian entities. This creates particular challenges for multinational corporations with Peruvian subsidiaries, as taxpayers must demonstrate that the original acquisition price for foreign shares passed through the Peruvian financial system—a requirement that poses practical difficulties for historical acquisitions.

【Lawshi Professional Insight】

Recent legislative amendments have addressed some concerns for acquisitions occurring after April 2022, but historical transactions remain problematic. The requirement for global transactions to utilize Peru's financial system represents an assertion of extraterritorial jurisdiction that continues to face legal challenges. Until clearer precedents emerge, conservative compliance remains the safest approach.

The current interpretation by Peruvian tax authorities effectively asserts jurisdiction over global transactions, creating significant obstacles for international M&A activity involving Peruvian assets. While legal challenges continue regarding the scope of these rules, prudent investors should assume strict compliance will be required during audits and transaction reviews.

Strategic Planning for Peruvian Investments

Successful navigation of Peru's investment landscape requires careful advance planning. The banking channeling requirement demands early attention to payment structures, while the indirect transfer rules necessitate comprehensive due diligence for any international transaction involving entities with Peruvian assets. Document retention proves crucial for establishing tax basis in future dispositions, and understanding the valuation methodologies can significantly impact tax liabilities.

As Peru continues to refine its tax policies, foreign investors benefit from proactive legal counsel that can anticipate regulatory challenges and structure transactions to minimize unforeseen tax consequences while maximizing compliance with local requirements.