Colombia has established itself as a premier investment destination within Latin America, consistently earning recognition from international institutions like the World Bank for its robust investor protections. The country's progressive regulatory environment, combined with constitutional safeguards for private enterprise and foreign investment, creates fertile ground for international business expansion. However, successfully navigating the local corporate landscape requires understanding key regulatory frameworks and selecting appropriate business vehicles.

Fundamental Principles for Foreign Investment

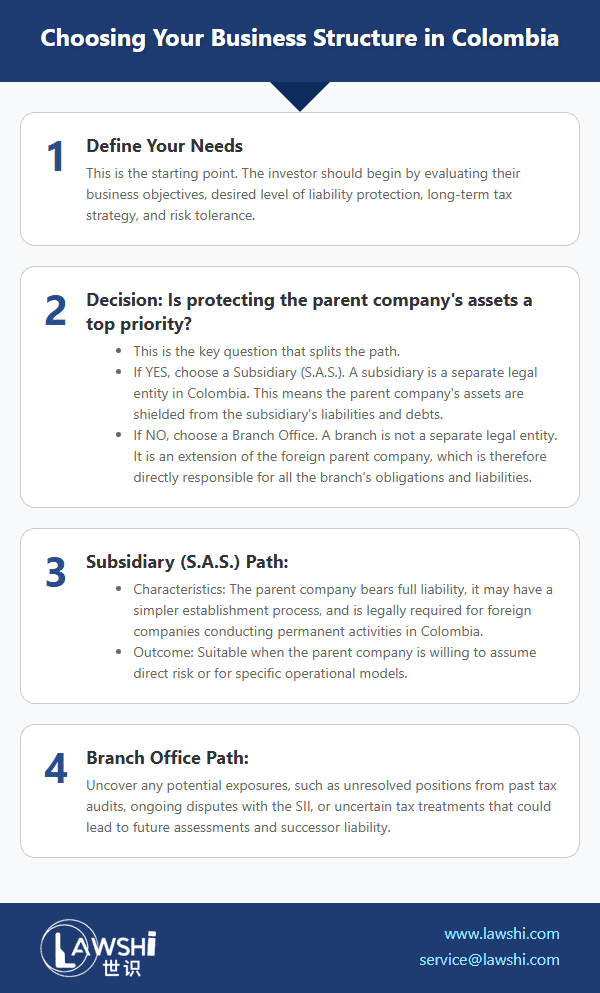

Colombia's corporate legal system demonstrates remarkable stability, having evolved through thoughtful legislative development that balances business flexibility with regulatory oversight. Foreign investors engaging in permanent business activities must typically establish a local presence through subsidiaries or branches, though the regulatory framework offers significant freedom in how these entities are structured and operated.

The Colombian commercial framework stands out for its modernity, particularly regarding subsidiary formations. The system permits sole-shareholder investment vehicles with limited liability protection, eliminating the historical requirement for local partners in most sectors. Foreign investors can maintain complete ownership of Colombian entities and face minimal restrictions on capital repatriation, providing substantial operational autonomy.

【Lawshi Professional Insight】

Colombia's constitutional protection of foreign investment extends beyond mere ownership rights to include guarantees against arbitrary regulatory changes. The country's network of international investment treaties provides additional layers of protection, making it one of the most secure jurisdictions in the region for foreign capital.

Entity formation in Colombia generally follows streamlined procedures that don't require prior government approval for most industries. This administrative efficiency, combined with predictable regulatory processes, significantly reduces the barriers to market entry for international companies.

Primary Business Structures for Permanent Operations

Commercial Company Formations

The Colombian commercial landscape offers several entity types, with three structures predominating for foreign investment:

The Simplified Stock Company (Sociedad por Acciones Simplificada - S.A.S.) has emerged as the preferred vehicle for both domestic and foreign investors, owing to its remarkable administrative flexibility and streamlined incorporation process. This structure allows shareholders considerable freedom in defining operational terms and internal governance arrangements, making it particularly suitable for ventures requiring customized management approaches.

【Lawshi Practical Tip】

When establishing an S.A.S., we recommend carefully drafting the company's bylaws to include detailed provisions regarding share transfer restrictions, dispute resolution mechanisms, and corporate governance procedures. Well-crafted foundational documents can prevent future conflicts and provide clear guidance for managing business evolution.

A notable development in Colombia's corporate landscape includes the introduction of "Benefit and Collective Interest Companies" (BIC) under Law 1901/2018. This designation recognizes companies that integrate environmental, community, and worker considerations into their corporate purpose. Importantly, the BIC status represents a quality seal for social and environmental practices rather than creating a new legal entity type or providing tax advantages.

Limited liability companies and traditional corporations (Sociedad Anónima - S.A.) remain available, though the S.A.S. typically offers superior flexibility for most medium-sized investments. The choice between structures should consider factors including capital requirements, governance preferences, and long-term strategic objectives.

Branch Office Operations

Foreign companies may establish branches in Colombia as an alternative to subsidiary formations, though important legal distinctions exist between these approaches. Branches operate as extensions of the parent company rather than separate legal entities, meaning the foreign headquarters assumes direct responsibility for all obligations incurred through Colombian operations.

The Commercial Code mandates that foreign companies conducting permanent activities in Colombia must maintain a registered branch office within national territory. The concept of permanent activity for corporate purposes differs from the tax notion of permanent establishment, though both require careful analysis to ensure compliance.

【Lawshi Exclusive Service】

Our firm provides comprehensive entity selection analysis, weighing factors including liability protection, tax implications, administrative requirements, and exit strategies. We assist clients in establishing optimal structures that align with their business objectives while ensuring full compliance with Colombian corporate and tax regulations.

Strategic Considerations for Market Entry

The selection between branch and subsidiary structures involves evaluating multiple factors beyond initial setup requirements. While branches may offer simpler establishment processes, subsidiaries typically provide stronger liability protection for parent companies. Tax considerations, including the ability to utilize tax treaties and optimize local tax positions, often favor subsidiary formations for long-term operations.

Colombia's regulatory environment continues to evolve toward greater transparency and efficiency, with recent reforms focusing on digitalization of corporate procedures and enhanced corporate governance standards. Foreign investors benefit from this trajectory, though it necessitates ongoing compliance monitoring to maintain optimal operational status.

The country's commitment to investor protection, evidenced by its constitutional framework and international rankings, provides substantial confidence for foreign capital. By understanding the nuances of Colombia's corporate regulations and selecting appropriate business vehicles, international companies can effectively leverage the opportunities within this dynamic market while mitigating operational risks.