Argentina's multi-layered taxation system presents both challenges and opportunities for foreign investors seeking to establish or expand operations in the country. The distribution of taxing authority across federal, provincial, and municipal levels creates a comprehensive regulatory environment that demands strategic planning and diligent compliance. This overview examines key aspects of Argentina's corporate tax regime to assist international businesses in navigating this complex landscape.

Tax Compliance Procedures and Payment Systems

The Argentine tax system operates on a self-assessment principle, requiring taxpayers to proactively calculate their liabilities through periodic filings. Corporate entities must submit annual income tax returns within five months following their fiscal year-end, while monthly filings address other federal tax obligations. This system places significant responsibility on taxpayers to maintain accurate records and implement robust internal compliance mechanisms.

【Lawshi Professional Insight】

The self-assessment model in Argentina necessitates sophisticated internal controls and documentation practices. Companies should implement comprehensive tax calendar management systems to track filing deadlines across federal, provincial, and municipal jurisdictions. Missing deadlines can result in substantial penalties, even when no additional tax liability exists.

For foreign entities without established Argentine presence, the withholding tax system typically satisfies income tax obligations, eliminating the requirement for formal tax return submission. However, this simplified compliance comes with reduced opportunities for tax optimization and requires careful monitoring to ensure proper withholding application across different income categories.

Tax Calculation Methodologies

Argentine tax authorities employ a detailed framework for tax calculation that primarily relies on taxpayer-provided financial information. The system presumes accurate record-keeping and transparent reporting, with estimated assessments representing a measure of last resort rather than standard practice.

【Lawshi Practical Tip】

Maintaining meticulous accounting records and supporting documentation is crucial in Argentina's tax environment. The tax authorities increasingly leverage digital cross-checking systems to verify information across different reporting platforms. We recommend implementing regular internal audits to ensure consistency between financial accounting, tax reporting, and other regulatory filings.

Corporate Taxation Framework

Tax Rate Structure

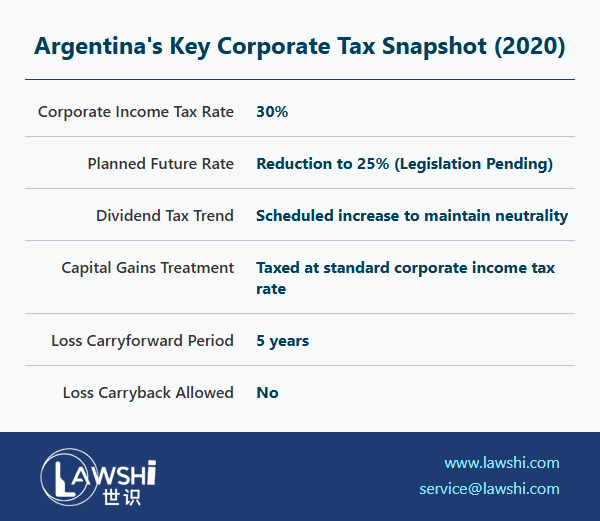

Argentina's corporate income tax rate stands at 30%, with legislation indicating a planned reduction to 25% in the near future. The dividend distribution tax regime is undergoing parallel adjustments, with rates scheduled to increase as corporate rates decrease, maintaining overall tax neutrality on distributed profits.

Territorial Application

Argentine tax residents face worldwide income taxation, including earnings generated through foreign branches and subsidiaries. The treatment of foreign subsidiaries varies based on specific tax transparency elections, with some structures requiring immediate taxation of undistributed earnings. This global taxation approach necessitates comprehensive international tax planning for Argentine-based multinational enterprises.

Business Income Classification

The definition of business income encompasses various revenue streams, including sales proceeds, investment income, and foreign exchange gains. The specific treatment of inventory-derived profits follows defined calculation methodologies, while other income categories receive broader characterization under general tax principles.

Capital Gains Treatment

Unlike some jurisdictions that provide preferential rates for capital transactions, Argentina taxes corporate capital gains at standard income tax rates. This uniform treatment simplifies compliance but reduces opportunities for tax-efficient structuring of asset dispositions.

Loss Utilization Provisions

The Argentine tax system permits net operating loss carryforwards for up to five years, though carryback provisions remain unavailable. This limited loss utilization period requires strategic timing of deductions and income recognition to maximize tax benefit recovery.

【Lawshi Exclusive Service】

Our firm provides integrated tax planning services that coordinate Argentine compliance with global tax strategies. We assist clients in optimizing loss utilization, managing international tax transparency elections, and structuring operations to align with Argentina's evolving tax framework while maintaining global tax efficiency.

Special Considerations for Foreign Entities

Non-resident companies operating in Argentina face withholding tax obligations on Argentine-source income, with rates varying by income classification. The exemption for import-related income provides significant benefits for foreign suppliers, though specific conditions must be met to qualify for this preferential treatment.

Portfolio investment income receives specialized treatment, with optional calculation methods allowing taxpayers to select between gross-basis and net-basis taxation. Foreign investors benefit from exemptions for certain publicly-traded securities, though careful analysis is required to determine eligibility for these preferences.

The indirect taxation rules for shares represent a particularly complex aspect of Argentina's international tax provisions. These regulations can create Argentine tax obligations for non-residents disposing of foreign entities holding Argentine assets, requiring sophisticated analysis of ownership structures and asset valuations.

Strategic Tax Planning Considerations

Argentina's evolving tax landscape demands proactive planning and regular compliance reviews. The scheduled reductions in corporate tax rates create timing considerations for income recognition and deduction planning, while the expanding digital capabilities of tax authorities increase the importance of data consistency across reporting platforms.

International businesses operating in Argentina should develop comprehensive tax strategies that address not only federal income taxes but also provincial turnover taxes, municipal levies, and specialized industry-specific assessments. This integrated approach ensures optimal tax positioning while maintaining full compliance across all relevant jurisdictions.

The complexity of Argentina's multi-layered tax system, while challenging, also presents opportunities for businesses that invest in developing sophisticated tax expertise and compliance infrastructure. With proper planning and expert guidance, companies can effectively navigate this environment while optimizing their overall tax position.