Argentina presents compelling opportunities for international investment, characterized by abundant natural resources, a substantial consumer market with significant purchasing power, and a well-educated workforce. The country's evolving regulatory environment demonstrates increasing openness to foreign participation across economic sectors, creating favorable conditions for business establishment and expansion.

Argentina's Investment Landscape and Regulatory Framework

Argentina maintains a generally welcoming stance toward foreign investment, with minimal restrictions on international shareholder participation. Non-nationals enjoy largely equivalent rights to domestic investors, including the ability to acquire substantial ownership positions in local enterprises without specialized approvals in most sectors. This inclusive approach extends across the economic spectrum, though certain strategic industries may involve additional regulatory considerations.

【Lawshi Professional Insight】

While Argentina's investment environment is generally favorable to foreign participation, investors should conduct thorough sector-specific due diligence. Certain regulated industries including media, defense, and border area real estate may involve ownership restrictions or require special approvals. Additionally, recent economic measures have created unique opportunities in infrastructure development that align with national priorities.

Selection of Business Structures

Branch Office Establishment

Branch offices function as extensions of foreign parent companies rather than distinct legal entities. While requiring registration with Argentina's Registry of Companies, these operations remain governed primarily by the laws of the company's home jurisdiction. This structure provides operational presence while maintaining centralized control, though it exposes the entire parent company's assets to potential liabilities arising from Argentine operations.

The branch framework mandates appointment of a legal representative with comprehensive authority to manage local operations, though such powers may be circumscribed through specific limitations. Separate accounting maintenance and periodic financial statement submissions to the Registry of Companies represent ongoing compliance requirements for branch operations.

Corporations (Sociedad Anónima)

Corporations represent Argentina's most formal business structure, suitable for enterprises contemplating future public offerings or significant capital raising initiatives. The requirement for minimum two shareholders prevents extreme ownership concentration, while the absence of maximum shareholder limitations accommodates growth and investment diversification.

【Lawshi Practical Tip】

The corporation's capital requirement of ARS $100,000 necessitates careful financial planning, particularly considering Argentina's periodic currency fluctuations. We recommend consulting with local financial experts to determine optimal capital structures that balance regulatory requirements with operational needs while managing exchange rate exposure.

The administration of corporations may include international managers, though residency requirements mandate that most administrators maintain permanent Argentine domicile. This balance permits some international participation while ensuring adequate local presence for regulatory compliance.

Limited Liability Companies (Sociedad de Responsabilidad Limitada)

Limited liability companies offer a flexible structure for small to medium enterprises, with shareholder limits between two and fifty participants. The absence of fixed minimum capital requirements provides adaptability, though capitalization must remain reasonable relative to planned business activities.

This structure prohibits public share offerings but facilitates simpler structural modifications compared to corporations. The management framework typically involves multiple managers with equivalent representative authority, while the entity structure provides personal asset protection against business liabilities.

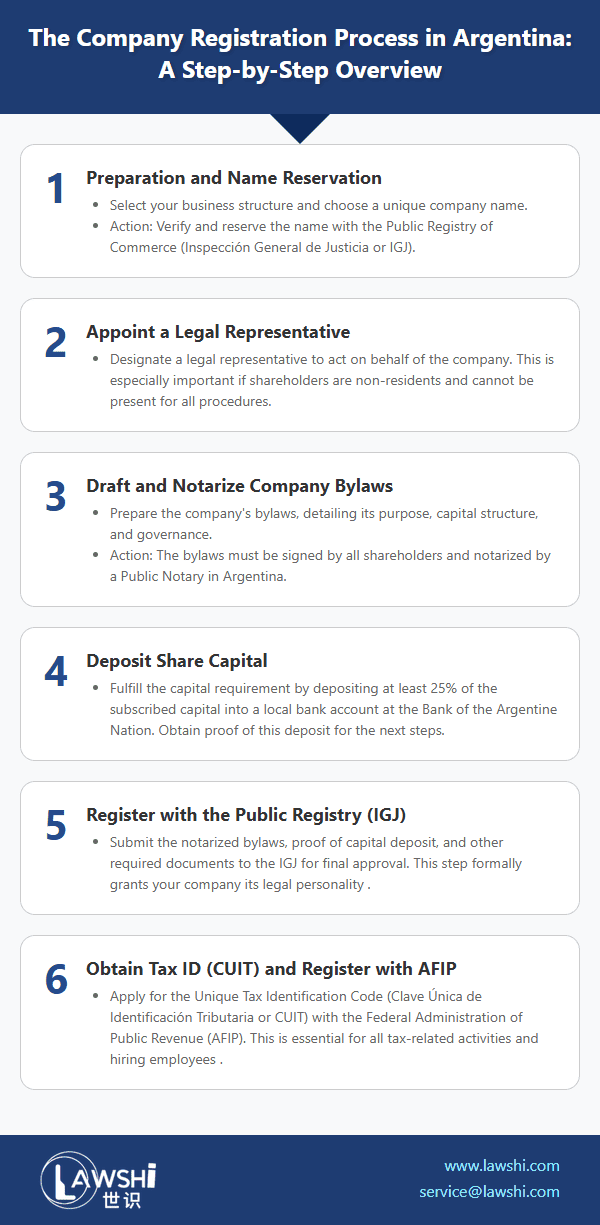

Company Registration Procedures

The company establishment process in Argentina involves multiple coordinated steps that require careful attention to documentation and timing. The initial phase involves obtaining Unique Tax Identification Codes (CUIT) for all shareholders and administrators through the Federal Administration of Public Income (AFIP).

The preparation of company bylaws demands particular attention to ensure compliance with Argentine commercial law while accommodating specific business requirements. The capital deposit requirement of 25% with the National Bank of Argentina represents a critical step in demonstrating financial commitment and enabling registration progression.

【Lawshi Exclusive Service】

Our firm provides end-to-end company registration support in Argentina, managing the complete process from CUIT acquisition for international shareholders to final commercial registration. We specialize in preparing compliant corporate bylaws, coordinating banking requirements, and navigating the IGJ registration process to ensure efficient market entry.

The notarization of company bylaws and subsequent registration with the General Inspection of Justice (IGJ) formalize the company's legal existence. The final step involves obtaining the company's own CUIT identification, completing the foundational phase of business establishment.

Legal Representation Requirements

Argentina's framework for legal representatives demonstrates inclusivity toward international participants, permitting foreign nationals to serve as company representatives provided they meet age requirements, obtain CUIT identification, and maintain Argentine domicile. The prohibition against corporate entities serving as legal representatives ensures clear individual accountability.

For international shareholders unable to participate directly in registration procedures, the implementation of specialized powers of attorney facilitates compliant representation. These instruments require careful drafting to ensure adequate authorization while maintaining appropriate oversight mechanisms.

Strategic Considerations for Market Entry

Argentina's business establishment environment continues evolving, with recent reforms generally trending toward reduced bureaucracy and enhanced digitalization of government services. Prospective investors should consider both immediate registration requirements and longer-term operational factors, including tax optimization, employment regulations, and industry-specific licensing.

The country's economic transformation presents unique opportunities in sectors aligned with national development priorities, particularly infrastructure, technology, and export-oriented industries. By understanding the specific registration pathways and implementing strategic approaches to corporate structuring, international investors can effectively navigate Argentina's business landscape while positioning their operations for sustainable growth.

Argentina's combination of market potential, evolving regulatory frameworks, and generally welcoming approach to foreign investment creates compelling conditions for international expansion. With proper guidance and strategic planning, investors can establish robust operational foundations that support both immediate objectives and long-term strategic goals within the Argentine market.