Mexico's dynamic economy and strategic trade position continue to attract significant foreign investment, with its corporate legal framework offering multiple pathways for market entry. Understanding the nuances between different business structures enables investors to select optimal vehicles that align with both immediate operational needs and long-term strategic objectives.

Corporate Structure Selection: Balancing Flexibility and Compliance

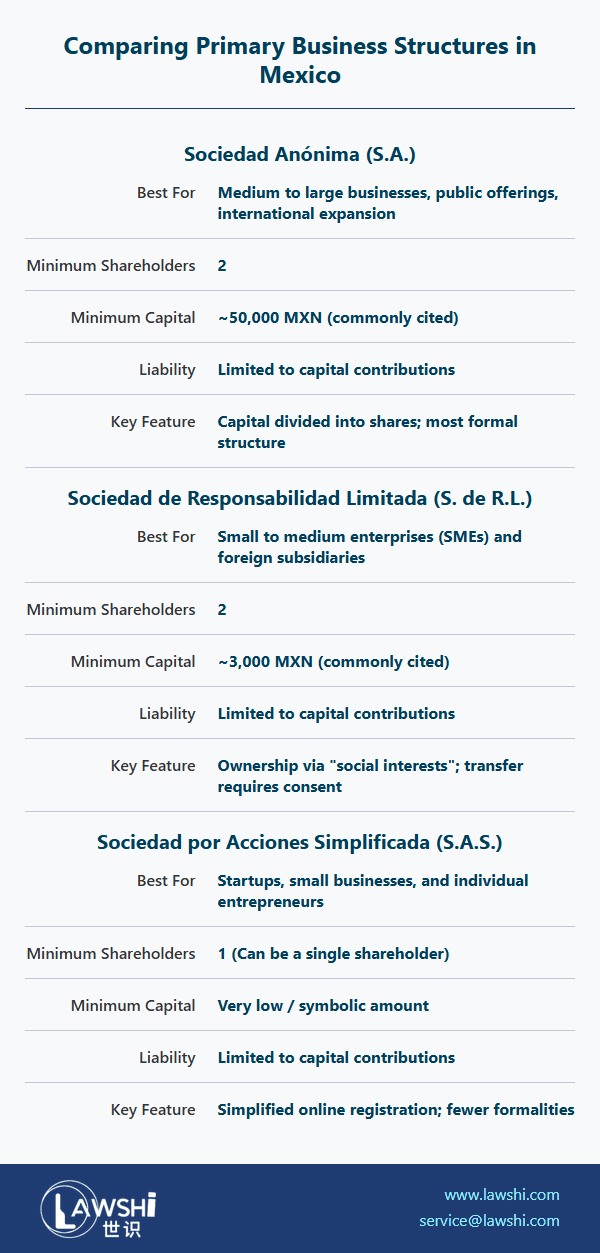

Mexico presents three primary corporate vehicles for international investors, each with distinct characteristics governing ownership, administration, and operational flexibility. The Sociedad Anónima (Corporation) with Variable Capital and Sociedad de Responsabilidad Limitada (Limited Liability Company) represent the most established structures, while the relatively new Sociedad por Acciones Simplificada (SAS) offers streamlined processes for smaller ventures.

【Lawshi Professional Insight】

The selection between corporate structures in Mexico involves considerations beyond initial setup simplicity. While the SAS offers apparent administrative advantages, its restrictions on annual revenue (capped at 5 million pesos) and shareholder composition limit scalability. Corporations provide the most robust framework for businesses anticipating significant growth, international expansion, or future capital raising activities.

Foreign investment restrictions in Mexico remain limited, primarily affecting sectors deemed crucial to national security and strategic industries. Most business activities face no ownership limitations, though specific sectors including energy, telecommunications, and transportation may involve additional regulatory considerations or ownership restrictions.

Corporation (Sociedad Anónima) Framework

The Corporation represents Mexico's most versatile business structure, suitable for enterprises ranging from small ventures to large publicly-traded entities. The absence of fixed minimum capital requirements provides flexibility, though practical considerations typically recommend initial capitalization of at least MXN $100,000.

【Lawshi Practical Tip】

While Mexican law doesn't mandate minimum capital for Corporations, establishing adequate initial capitalization demonstrates business seriousness to authorities and potential partners. Additionally, shareholder liability protection can be compromised under specific circumstances, particularly regarding tax compliance failures. Maintaining proper corporate records and timely regulatory filings is essential to preserving limited liability protection.

Corporate governance follows a structured approach involving shareholders, directors, and statutory auditors. The requirement for at least two shareholders presents no nationality restrictions, while administration may be vested in either a sole administrator or board of directors. The statutory auditor role, typically filled by external accounting professionals, provides essential oversight and compliance verification.

The mandatory corporate documentation includes stock registries, meeting minutes, and capital variation records when utilizing the variable capital structure. These records require meticulous maintenance as they serve as legal evidence of corporate decisions and ownership transitions.

Limited Liability Company (Sociedad de Responsabilidad Limitada) Structure

The Limited Liability Company shares many characteristics with Corporations while incorporating specific differences in capital representation and ownership transfer mechanisms. Social interests replace shares as ownership instruments, while partner approval requirements for new member admissions create a more controlled ownership environment.

The administration structure utilizes managers rather than directors, with surveillance committees providing governance oversight. The partner maximum of fifty positions this structure favorably for medium-sized enterprises and joint ventures where ownership stability represents a priority.

Simplified Stock Company (SAS) Innovation

The SAS introduction represents Mexico's commitment to reducing bureaucratic barriers for small businesses and startups. The digital formation process, elimination of notary requirements for establishment, and streamlined administration reflect significant advances in business facilitation.

【Lawshi Exclusive Service】

Our firm provides comprehensive entity selection analysis that evaluates client objectives against each structure's advantages and limitations. We facilitate SAS registrations through Mexico's digital platforms while ensuring proper understanding of growth transition requirements when businesses exceed SAS limitations and need to convert to more robust corporate structures.

The SAS structure incorporates specific limitations ensuring its appropriate application to smaller ventures. The requirement for natural person shareholders, revenue restrictions, and uniform share characteristics position the SAS as an entry-level vehicle rather than a scalable corporate solution.

Specialized Financial Structure: SOFOM Entities

Multipurpose Financial Companies (SOFOM) provide specialized frameworks for financial services activities, offering distinct advantages including enforceable commercial documentation and specific tax treatments. The certification benefits for balance statements create efficient debt collection mechanisms, while VAT exemptions for qualifying financial activities enhance operational efficiency.

The regulatory requirements for SOFOM entities involve coordination with Mexico's financial authorities, including registration in the Financial Service Providers System and specific compliance program implementations. These requirements necessitate specialized expertise in financial regulations beyond standard corporate practice.

Variable Capital Modality Strategic Advantages

The Variable Capital modality available across all structures provides significant operational flexibility for capital management. The distinction between fixed minimum capital requiring formal modification procedures and variable capital adjustments without formalities creates an efficient mechanism for responding to evolving business needs.

The Mexican corporate landscape continues evolving, with recent reforms generally trending toward reduced bureaucracy and enhanced digitalization. However, the fundamental importance of proper corporate governance, meticulous record-keeping, and strategic tax planning remains constant across all business structures.

By understanding the specific characteristics, advantages, and limitations of each corporate vehicle, international investors can make informed decisions that support both immediate market entry objectives and long-term strategic goals within Mexico's dynamic business environment.